If you are disabled but are not collecting all the Social Security Disability Insurance (SSDI) benefits you are entitled to, perhaps it’s because you are making one or more of the common mistakes listed below.

If you are not disabled, please read and save this guide anyway, because you or a member of your family could become disabled at any time due to an accident or illness. You will then need to know about, and avoid, these common mistakes. As noted in The New York Times, “50 million people in the U.S. have some form of physical or mental disability. Nineteen percent of those between ages 16 and 64 are disabled, according to census data.”

9 Common Mistakes Made In Regard to Social Security Disability Benefits

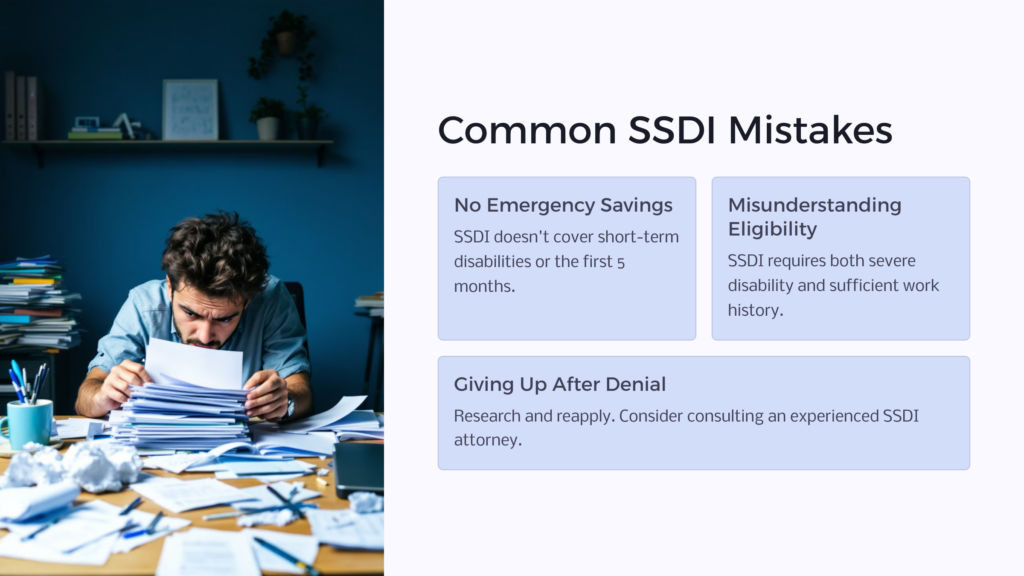

Mistake #1

You don’t put away any emergency cash to live on because you believe that Social Security Disability Insurance will pay monthly benefits if you become disabled and are unable to work for a short period.

FACT: SSDI pays benefits only to those with a physical and/or mental disability that is severe enough to keep them from performing substantial work for at least 12 months (or is expected to result in death). The Social Security Administration (SSA) does not pay benefits for short-term. Additionally, no benefits are paid for the first 5 full calendar months of disability. You’re on your own.

Mistake #2

You believe that SSDI benefits will be paid to anyone who becomes disabled and is unable to work for 12 months or longer.

FACT: That’s just one of the requirements. In addition, in order to qualify for SSDI benefits, your work history has to show that you’ve paid into the Social Security system—via payroll deductions or payment of self-employment tax―for a specified number of years. If you didn’t, then you’re not eligible for benefits, even if your disability is severe and long-lasting. (If your income is low, you may qualify for Supplemental Security Income (SSI).

Mistake #3

You applied for SSDI benefits without doing your “homework” and were turned down. You are really disabled, but you’ve given up on re-applying.

SUGGESTION: Do some research and try again. The SSA offers explanatory booklets for claimants, online information complete with Frequently-Asked Questions, and one-on-one consultations at their local offices, all free of charge. You’ll find out what you need to know in order to fill out claim or appeal forms accurately and completely and what additional information is required. However, it may be easier and more effective to consult a qualified law firm that has a track record of winning SSDI claims. They will be able to present your claim in a manner that clearly shows why you qualify.

Mistake #4

English is not your native language, and it’s very difficult for you to understand all the information provided by the SSA. So, you don’t even try to file a claim or to appeal a denial.

THE FACTS: Most of the information provided by the SSA is also available in Spanish and some correspondence is available in other languages. In addition, the SSA has interpreters (translators) available—usually via three-way phone conferences—to help applicants who speak Arabic, Armenian, Chinese, Farsi, French, Greek, Haitian-Creole, Italian, Korean, Polish, Portuguese, Russian, Spanish, Tagalog and Vietnamese.

Mistake #5

You decided you needed help in filing a claim or appealing a claim denial, so you plan to call your family lawyer.

A BETTER IDEA: Contact a law firm that has a proven track record in handling Social Security cases. Very few attorneys have the special training and years of hands-on experience needed to properly and successfully handle SSDI claims and appeals. It’s certainly no job for a jack-of-all-trades lawyer who handles everything from divorces to real estate transactions. There are certain aspects of SSDI that can be attended to only once and if handled incorrectly or too late you won’t get a second chance. So choose carefully.

Mistake #6

You assume that hiring an attorney who is experienced in Social Security disability will be too expensive.

THE FACTS: In most cases, SSDI attorneys work on a contingency basis. This means that if your claim is denied, the attorney receives no fee whatsoever. Your only cost is a minimal amount for any related expenses the attorney incurred, such as charges for medical records or photocopying.

When your claim or appeal is successful—thanks to your attorney’s expert advice and work—he or she receives (usually directly from the SSA) one-fourth of your back benefits or $6,000, whichever is less. To put this fee in perspective, after the initial fee is taken from your back pay, you will receive 100% of all future benefits. Since the average family benefit for a disabled worker is currently $2,011—over $24,000 a year—this would add up to $240,000 or more over 10 years if you continue to be disabled and unable to work. Your attorney’s fee is a good investment!

Mistake #7

You’ve been receiving SSDI benefits. But then the SSA suddenly informs you that your benefits will stop because you’re no longer considered disabled. So you take their word for it and do nothing about it.

FACT: The SSA’s decisions are not always correct. But they’re willing to be corrected—if you can convince them that an error has been made. Here’s where an attorney with SSDI expertise can be especially helpful in finding out what caused the SSA to decide to stop your benefits and what’s needed to prove that you are still disabled and unable to return to work. Your attorney may have to appear at a hearing or in federal court on your behalf, so it’s vitally important to have qualified representation. Note, however, if you request payment continuation during your appeal, you will have no back benefits due if you win. This means that you would have to pay a normal retainer to an attorney for him or her to take your case.

Mistake #8

Your young child is disabled, but you don’t apply for benefits.

ACT NOW: Not having worked and paid SSDI taxes, your minor child won’t qualify for Social Security disabled worker’s benefits, but he or she may qualify for benefits under the Supplemental Security Income (SSI) program. If your family’s income and assets fall below the allowable limit and your child meets the SSA’s definition of childhood disability, he or she may qualify for SSI benefits. Your child is disabled if

1) He or she has a physical and/or mental condition that results in marked and severe functional limitations that seriously limit activities; and

2) The condition has lasted, or is expected to last, at least one year or is expected to result in death.

Mistake #9

Your family has too many assets for your 17-year-old disabled child to get SSI so you give up on getting financial help for him.

APPLY LATER: Once your child turns 18, his or her parents’ income and assets are not considered in determining his or her eligibility for Supplemental Security Income (SSI). You can help your child file an SSI application two months before his or her eighteenth birthday. You should also gather and keep a copy of your child’s medical records that show disability began prior to age twenty-two. That way when you retire or become disabled and draw Social Security benefits, your unmarried child who became disabled before age 22 may be able to draw benefits on your account.

Regardless of which of the above mistakes apply to you, it makes sense to apply—or reapply or appeal—for all the disability benefits you’re entitled to.

7 Common Misconceptions about Social Security Disability Benefits

Disability, whether physical or mental and regardless of cause, can affect anyone.

Disability, whether physical or mental and regardless of cause, can affect anyone.

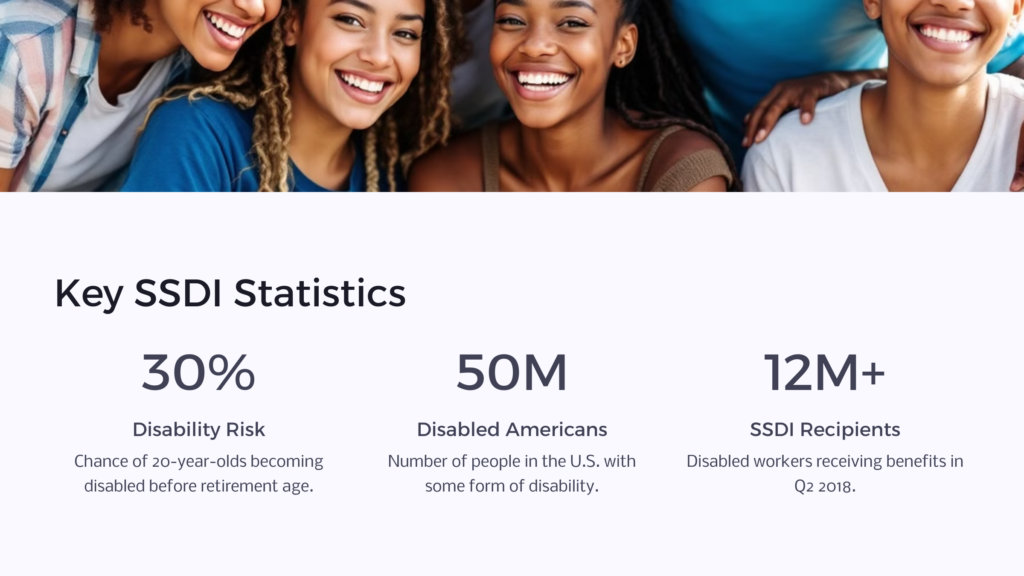

In fact, according to the Social Security Administration (SSA), nearly 3 out of every 10 of today’s 20-year-olds—even those in perfect health—will become disabled before they reach age 67, which will be their Social Security Normal Retirement Age. Currently, some 50 million people in the U.S. have some form of physical or mental disability, according to census data. The longer you live, the greater the chances are that, on or off the job, you will become disabled, too.

If you are already disabled, are too young to qualify for retirement Social Security benefits, and have earned enough work credits under the Social Security system while self-employed or working for others, you may be eligible for Social Security Disability Insurance (SSDI) benefits.

Whether or not you collect all the Social Security Disability Insurance (SSDI) benefits you’re entitled to—which could add up to tens of thousands, even hundreds of thousands of dollars over the years—may depend on how well you understand the SSDI system and on how you go about applying for your benefits.

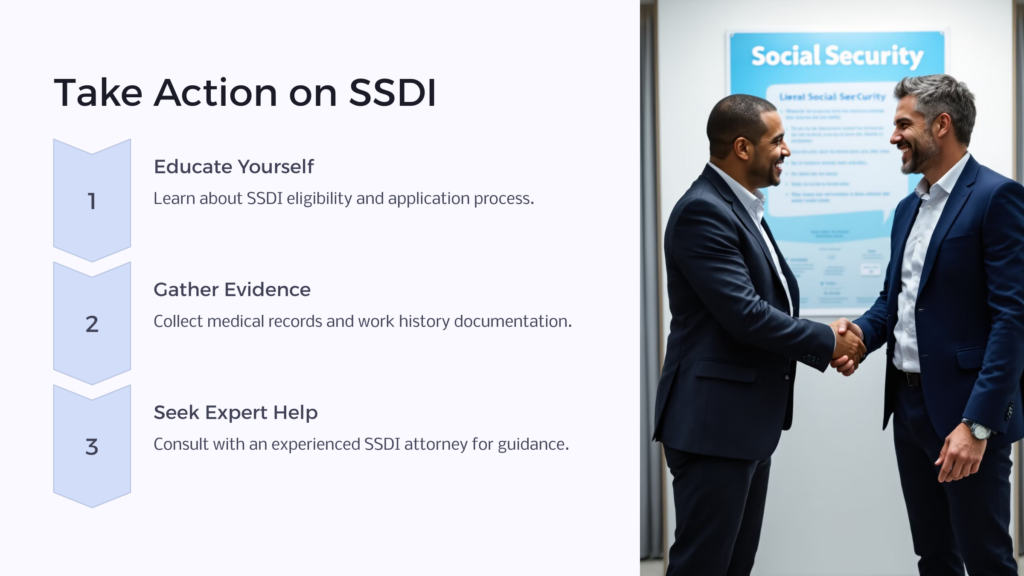

Here are some of the most common misconceptions about Social Security Disability benefits and what you should know to start collecting if you’re eligible.

Misconception #1

The Social Security Disability Insurance (SSDI) program is too complicated. So I’m not even going to apply, although I’m truly disabled.

Fact: Social Security Disability law is not complicated, but it is foreign to anyone who does not work with it frequently so it can be overwhelming. There are certain law firms that focus on representing people in their SSDI claims. These firms, which have handled a lot of SSDI claims, bring you expertise that an attorney can’t learn just by reading a book or two; so when you hire an attorney, be sure to get legal representation with an SSDI track record. One of these SSDI-experienced attorneys can explain everything and shepherd your claim or appeal through the whole process.

Misconception #2

The SSDI benefit payments aren’t very big. So why bother to apply for them?

Fact: In 2018, the average monthly SSDI benefit for a disabled worker with a spouse and at least one child was $2,051. That’s $24,612 a year! That adds up to more than $246,000 over a 10-year period—a life-saver if the disability continues and there’s little or no other money coming in. All disabled workers including those with and without families averaged a $1,197 monthly benefit for themselves. That’s over $143,000 in a ten-year period. Neither of these figures includes cost-of-living increases given in many years. But regardless of the payment amount you may receive, if it’s money you’re entitled to, why not claim it?

Misconception #3

All I need to apply for benefits is a note from my doctor saying that I’m disabled.

False! It’s wise to get your doctor’s opinion, of course; but you’ll need a lot more than that to qualify for any SSDI benefits. Evidence needed for your claim includes your work history and your medical records pertaining to your disability including test results and medications. After these are submitted, your claim will then undergo a thorough review by the Disability Determination Services (DDS) of your state.

Misconception #4

It won’t take long to get approved since I’m obviously disabled. I’ll apply as soon as I get around to it.

Bad idea! Typically, it will take from three to five months to get a decision on your claim (except for some extremely severe disabilities such as spinal cord injuries or terminal cancer, which are fast-tracked). Then, when your claim is approved, figure another month or two until you actually receive your first benefit payment. Of course, if your claim is turned down and you apply again or file an appeal, it will take even longer. In addition, if you wait longer to file than 17 months after you became disabled, you will lose some benefits.

Misconception #5

In order to save money, the system is rigged to disqualify as many people as possible from collecting benefits.

False. The government is looking for ways to keep Social Security funded, but this does not affect how claims are processed. People who are truly disabled according to Social Security’s rules will be approved if they present their cases clearly. Of course, some people are denied either by mistake and get approved on appeal or are denied because they do not meet the disability requirements. That said, at the beginning of the second quarter of 2018, more than 12 million disabled workers were receiving Social Security Disability benefits and more than 4 million were receiving Supplemental Security Income only (based on disability).

Misconception #6

Even if I’m approved, I won’t receive any benefits in the years ahead because the Social Security system is practically broke.

Fact: Several solutions are being sought by the President and Congress, and it’s likely that additional funding will be found long before then. Therefore, if you’re eligible, apply for benefits now and see how we can help!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.