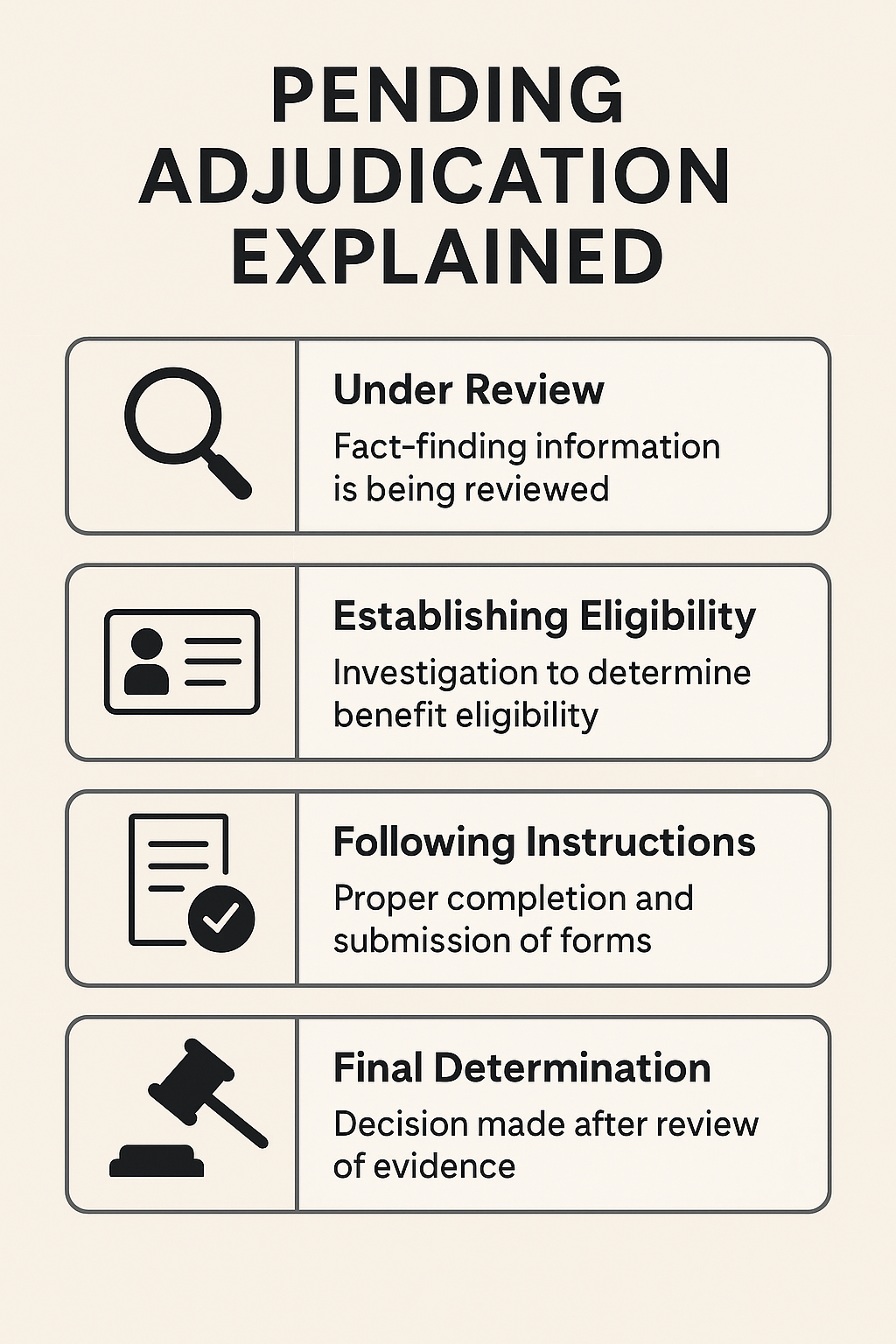

Pending adjudication means your claim is currently undergoing a detailed review by the Social Security Administration (SSA) to determine your eligibility for benefits.

This stage involves a thorough investigation to resolve specific, often non-monetary, issues, or to verify submitted information, such as medical records or work history. The SSA may require additional documentation, clarification, or even an interview or other further action to complete their assessment. While your claim is pending, no final decision has been reached, and benefits are not yet approved.

This process can introduce delays, potentially taking weeks or several months, as the SSA works through its caseload and gathers all necessary evidence to make a fair and accurate determination.

Why This Update

Social Security processes are an important part of benefits, and we want to make sure you have the most up-to-date information.

What ‘Pending Adjudication’ Means for Your Social Security Claim

When your Social Security claim enters pending adjudication status, it signals that your application has moved beyond initial submission and is now under active review. The SSA is working to determine your eligibility for benefits by resolving specific non-monetary or factual issues related to your application.

This goes beyond a simple waiting period—it’s an active investigative process where the agency gathers facts, reviews submitted documents, and potentially requests more evidence from you.

While a case is pending adjudication, the final rights and obligations of the parties involved remain undecided.

The adjudication process requires the SSA to make a formal determination based on all collected evidence. An adjudication officer gathers documentation and conducts interviews to determine eligibility for claims and future benefit payments. In some cases, separate determinations may be issued for different claim issues.

Your claim remains in this status until all necessary information has been gathered and reviewed, and the SSA has completed its assessment of whether you meet the eligibility requirements for benefits.

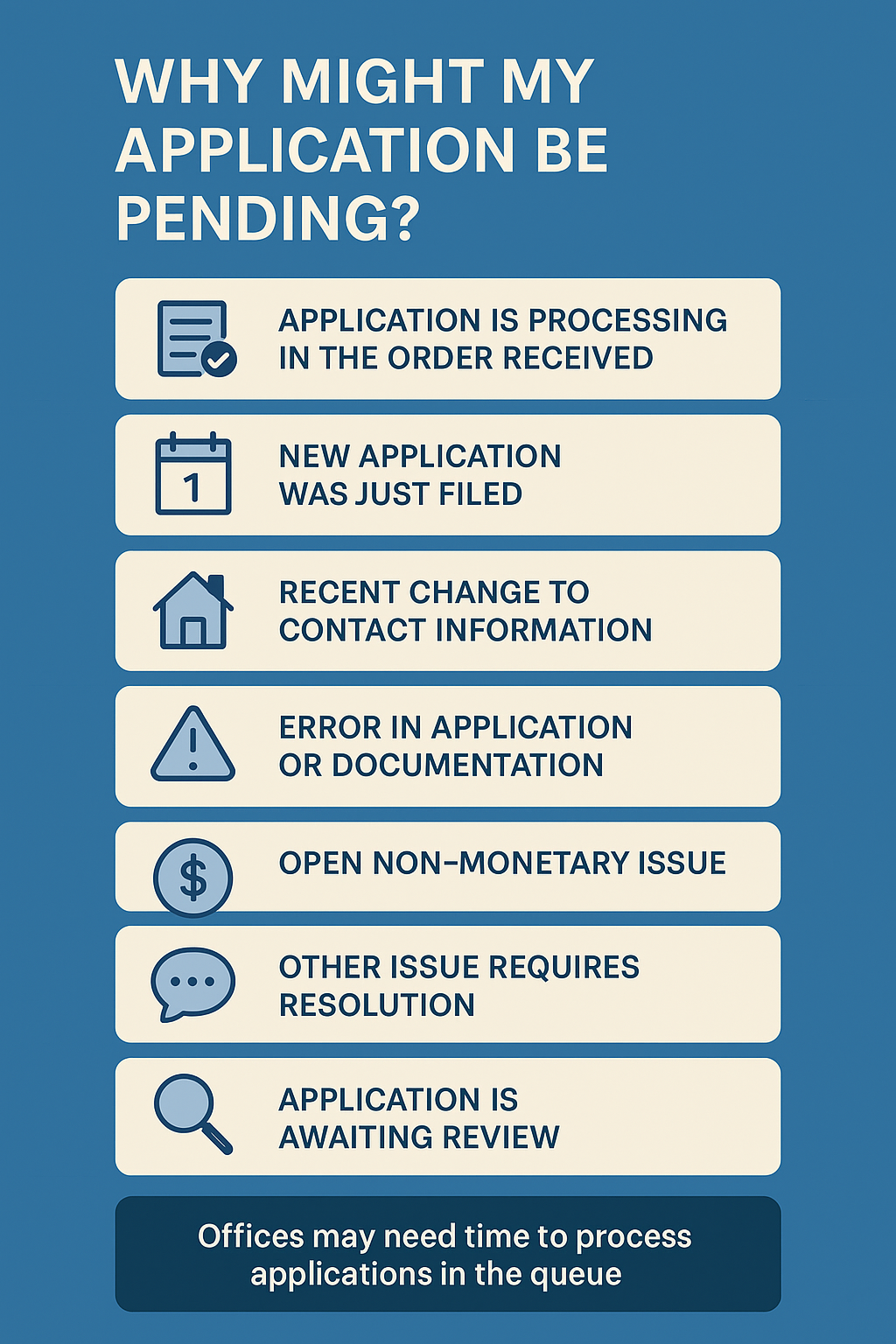

Common Reasons Your Social Security Claim Might Be Pending

Administrative processing time is one of the most common reasons for pending status, simply due to the high volume of applications the SSA receives. Even straightforward claims require time for proper review and verification. The SSA reviews each Social Security application thoroughly to ensure accurate determinations on each subject.

Your determination status may also be pending due to incomplete documentation, errors in your application, or outdated contact information requiring correction. Specific eligibility issues often need investigation, such as verifying your work history, reviewing medical evidence, or checking other criteria. The SSA may also need to conduct identity verification or background checks to ensure the validity of your claim.

Actions You Can Take While Awaiting a Decision

You can proactively contact your local Social Security office over the phone or in person, or use their online portal to inquire about your claim status as soon as you are notified of the adjudication process. When reaching out, have your claim number, your Social Security number, and personal information ready to help representatives locate your file and provide accurate updates.

The SSA also offers online status checking tools that allow you to monitor your application’s progress without needing to call.

Respond immediately and completely to any requests for additional information, documents, forms, or interviews from the SSA. Delays in answering requested information can significantly extend your processing time. Keep detailed records of all correspondence, submitted documents, and conversations with SSA representatives, including dates and names, to help you track your claim’s progress if you need to reference them later.

Consulting with legal counsel is often advisable if facing a notice of adjudication to ensure all necessary evidence is submitted before a final decision.

Understanding the Role of the Adjudication Officer

Adjudication officers, working within the Disability Determination Services (DDS), are responsible for gathering all necessary documentation and conducting interviews with applicants and relevant third parties. These professionals contact your medical providers, review submitted medical records, and may contact you directly if they need you to answer questions or provide additional information. Their role is to build a complete picture of your situation.

They analyze the collected data and investigate whether you qualify according to Social Security laws and regulations. This involves reviewing medical evidence, assessing how your condition affects your ability to work, and verifying that you meet both medical and non-medical requirements. This multi-step process may extend the overall timeframe, but helps ensure decisions are based on complete and accurate information.

Maintaining Eligibility and Staying Informed During Adjudication

Promptly report any changes to your address, contact information, or other relevant life circumstances to the SSA. Changes in your medical condition, employment status, or living situation could affect your determination. The SSA uses current information to make an accurate decision on your claim.

Regularly monitor your mail and any online SSA accounts for notices or requests for information. If you miss a request for additional documentation or a scheduled appointment, this may delay your claim or could result in a denial. Understand that if your claim is ultimately denied, you have the right to file an appeal, and the denial letter will provide instructions on how to proceed and the deadlines you must meet.

You should continue submitting your weekly certifications even if your claim is pending to maintain eligibility and ensure your claim is processed without interruption.

Example Scenario

Maria applied for Social Security Disability benefits after an injury that limited her ability to work. Her application status changed to “pending adjudication.” She then received a letter requesting additional medical records from a specialist she saw last year, along with clarification on her past employment history. Maria promptly submitted the requested information, knowing that the SSA needed this information in order for her to move her claim forward.

Frequently Asked Questions

What does ‘pending adjudication’ specifically mean for a Social Security disability claim?

Pending adjudication means your claim is under active review, and the Social Security Administration (SSA) is gathering or verifying information to determine your eligibility, often focusing on non-monetary issues.

How long does Social Security adjudication typically take?

The duration varies widely, from a few weeks to several months, depending on the complexity of the case, the completeness of your application, and the SSA’s current caseload.

What are common reasons for a Social Security claim to be pending adjudication?

Reasons include incomplete documentation, errors in the application, the need for further medical or work history verification, or simply the time required for administrative processing.

Can I still receive benefits while my Social Security claim is pending adjudication?

Generally, no. Benefits are typically not disbursed until a final eligibility determination is established. However, if you are appealing a denial, prior benefits may continue under certain circumstances.

What information might the SSA request during adjudication?

They might ask for additional medical records, clarification on your work history, details about your daily activities, or updated personal information relevant to your disability claim.

Should I contact the SSA if my claim is pending adjudication for a long time?

Yes, if you haven’t received any updates or requests for information within a reasonable timeframe (e.g., several weeks), consider contacting the SSA to inquire about your claim’s status.

What happens if my claim is denied after adjudication?

If your claim is denied, you typically have the right to appeal the decision. The denial letter will provide clear instructions on how to initiate the appeal process and applicable deadlines.

If you have more questions about your pending application, or any other benefits you are working towards, reach out to us here at Benefits.com! We want to help!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.