Any time a veteran dies from a service-connected injury or illness, or when service members die in service due to such causes, it can be devastating to loved ones close to them.

While going through grief, some family members may be worried about finances as well. In some cases, their spouse, children, or even their parents could be eligible for Dependency and Indemnity Compensation (DIC) payments.

These payments are designed to help support those left behind. DIC is a tax free monetary benefit, provided to eligible survivors of veterans and service members. But as with everything with the Department of Veterans Affairs (VA), there are some nuances you need to understand.

What Is Dependency and Indemnity Compensation (DIC)?

DIC is a benefit paid by the U.S. Department of Veterans Affairs (VA) to eligible survivors of veterans who died either in the line of duty or from a service‑connected condition. It can also apply to those who left service wholly disabled and whose death was related to that disability. Eligibility for DIC requires that a service member’s or veteran’s death must be related to a service-connected disability.

The VA DIC is a tax-free payment and helps provide ongoing financial assistance to spouses, children, and sometimes parents, recognizing the veteran’s sacrifice and the impact on their dependents. The veteran’s death or benefits are central to determining eligibility for DIC.

VA DIC Rates for 2025: What’s New

For the period beginning December 1, 2024, the base DIC payment rate for a surviving spouse of a veteran who died on or after January 1, 1993, is $1,653.07 per month. This is referred to as the basic monthly rate for DIC. That rate reflects an approximate 2.5 % cost‑of‑living adjustment (COLA) over the prior year.

In addition to the base rate, surviving spouses may qualify for added monthly amounts for certain conditions, including:

- If the veteran was rated totally disabled, or unemployable due to service‑connected conditions, for at least 8 years, and the spouse was married during those 8 years. ($351.02 added monthly)

- If the spouse requires Aid and Attendance ($409.53), or is Housebound ($191.85).

- For each dependent child under age 18, or older if attending school or permanently disabled. ($409.53 for each eligible child) Additional payments may also be available for a surviving child and for a helpless child over age 18.

- A “transitional” benefit for up to 2 years after the veteran’s death occurred if the spouse has minor children. ($350)

For veterans who died before 1993, the survivor rates differ, based on their ranking and pay grade. Monthly payments for survivors of veterans who died before 1993 range from $1,653.07 to $3,787.77. There are some qualifications for added amounts, but they are not as in-depth as they are for veterans who died after January 1, 1993.

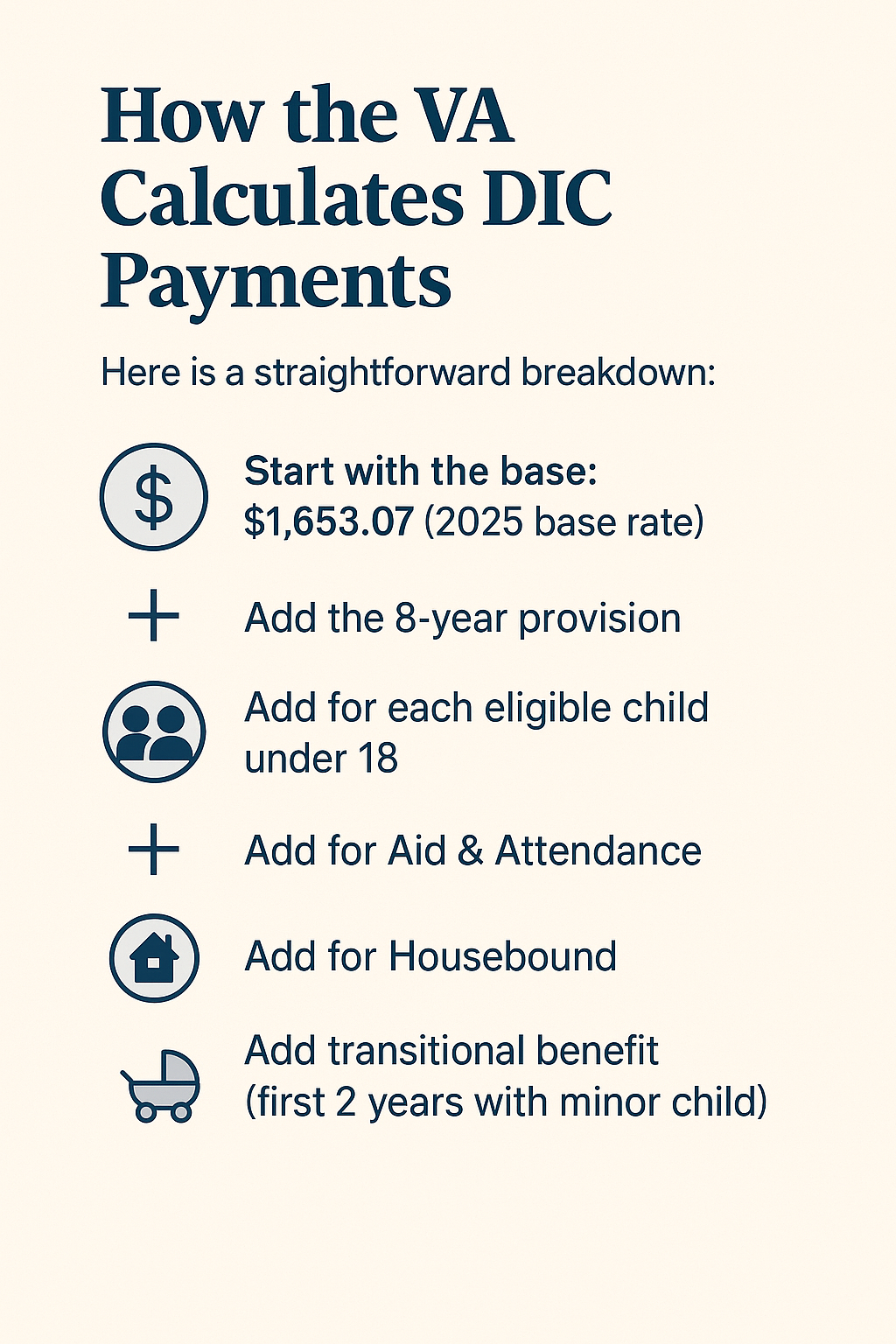

How the VA Calculates DIC Payments

The VA calculation for DIC payments for parents begins with the beginning monthly rate, which may be reduced based on income and income limits. Calculating your DIC payment starts with the base rate. Then the VA adds any additional allowances for your specific circumstances. Here is a straightforward breakdown:

- Start with the base: $1,653.07 (2025 base rate)

- Add the 8‑year provision: + $351.02

- Add for each eligible child under 18: + $409.53 per child

- Add for Aid & Attendance: + $409.53

- Add for Housebound: + $191.85

- Add transitional benefit (first 2 years with minor child): + $350.00 (for first 2 years)

Some additional allowances may depend on other eligibility criteria.

Each situation varies, so the final payment depends on how many and which conditions apply. In certain circumstances, it is possible to receive a full DIC payment.

Eligibility Requirements for VA DIC Benefits

To qualify for DIC, you must be a surviving spouse, child, or parent of a veteran who meets one of these criteria:

- The veteran died while on active duty or inactive‑duty training.

- The veteran’s death resulted from a service related injury.

- The veteran died and had been rated totally disabled due to service‑connected conditions for at least ten years, or for five years after discharge, or one year if a former POW who died after September 30, 1999. Totally disabling means the veteran was unable to work due to service-connected conditions, and this also applies if the veteran was a former prisoner.

A surviving parent may also qualify for DIC under certain circumstances, provided they meet the legal definition of parent and the required eligibility criteria.

For surviving spouses, additional criteria apply for remarriage and length of marriage. For example, if the spouse remarried before age 55, they may lose eligibility. The veteran’s death must be related to military service, and the relationship to the veteran is a key factor in determining eligibility for DIC.

The PACT Act expands eligibility for VA benefits and survivor claims. The PACT Act means that more conditions and exposures are now recognized, and survivors may be able to file or reopen PACT Act related claims.

Additional Payments for Dependents and Special Circumstances

Dependents matter. If you have one or more children under age 18 (or older if attending school or permanently disabled), you may qualify for added benefit amounts.

Likewise, if the veteran was totally disabled for a long period or if the spouse is housebound or needs aid and attendance, additional monthly money is added. These “add‑ons” can significantly increase the overall monthly payment.

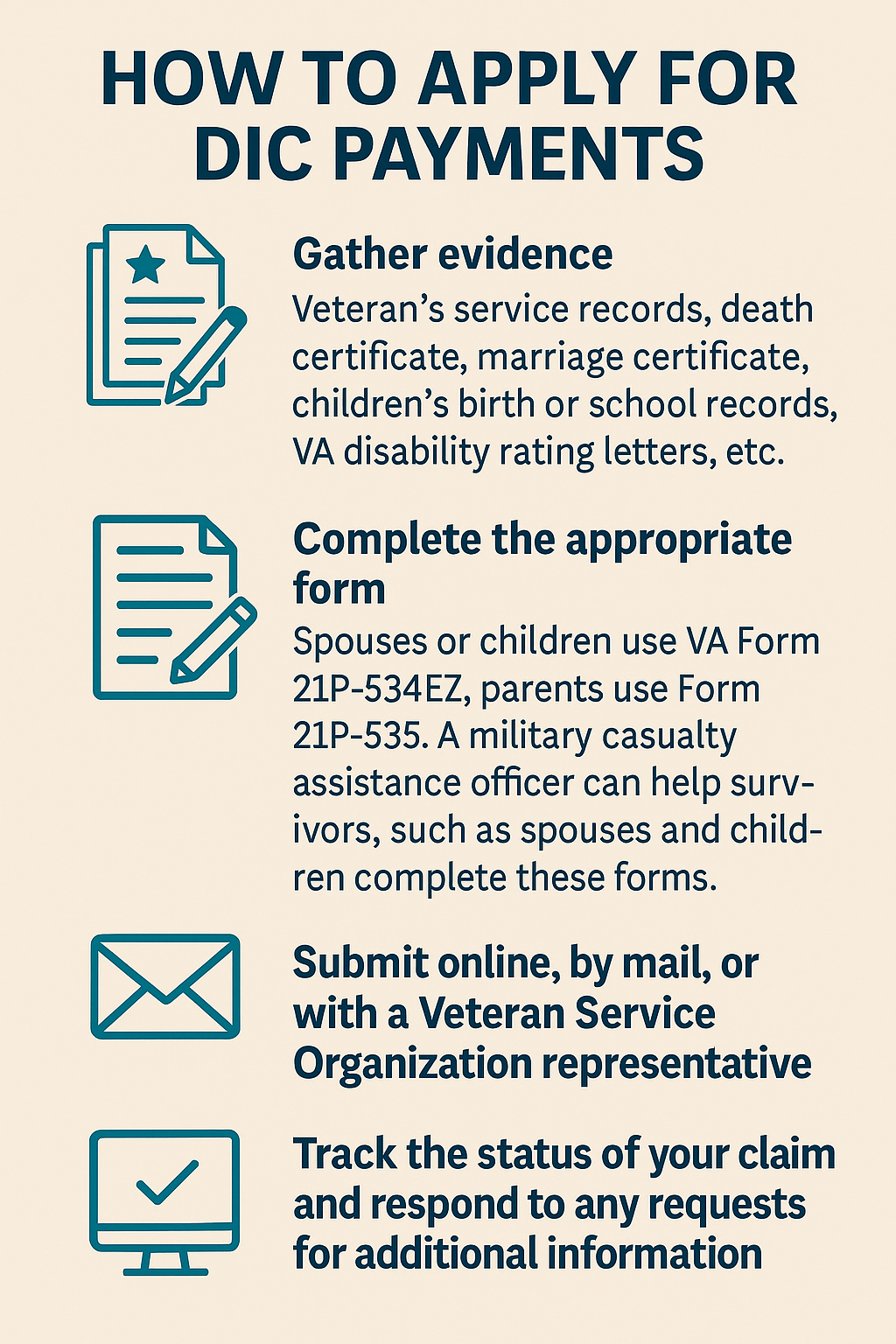

How to Apply for DIC Payments

The application process is important when it comes to DIC benefits. Here’s how to start:

- Gather evidence: Veteran’s service records, death certificate, marriage certificate, children’s birth or school records, VA disability rating letters, etc.

- Complete the appropriate form: Spouses or children use VA Form 21P‑534EZ; parents use Form 21P‑535. A military casualty assistance officer can help survivors, such as spouses and children, complete these forms.

- Submit online, by mail, or with a Veteran Service Organization representative. If submitting by mail, send the completed forms to the appropriate VA regional office.

- Track the status of your claim and respond to any requests for additional information.

Frequently Asked Questions About VA DIC Rate

Because many people qualify for VA DIC, but they don’t know much about the process or payments, there are a lot of questions that come up. Here are four of the most frequently asked.

- Are DIC payments tax‑free? Yes. DIC benefits are tax‑exempt.

- Does the base rate change each year? Yes. DIC is adjusted based on COLA and reflects inflationary changes. The new rates take effect on the official effective date set by the VA each year.

- What if the veteran died before January 1, 1993? Rates are calculated differently, often based on a veteran’s pay grade at the time of death.

- Can I receive DIC if the veteran wasn’t totally disabled? Yes, but only if the veteran died from a service‑connected injury/illness, or had met the total disability rating thresholds under certain rules.

- Can I receive both Survivor Benefit Plan (SBP) and DIC payments? Yes. The SBP-DIC offset has been eliminated, so eligible survivors can now receive both a full DIC payment and a full Survivor Benefit Plan payment at the same time. These benefits are no longer offset from each other, allowing survivors to receive both payments simultaneously.

Ensuring Your Benefits Match Your Sacrifice

For survivors of veterans, the DIC benefit is a vital financial safety net, one that reflects the nation’s promise to those who served and those they left behind.

If you qualify, or believe you might, don’t wait. Gather your documents, submit your application, and track your claim. In the end, you deserve a benefits package that honors service, sacrifice, and the future those veterans envisioned for their loved ones.

To get clear guidance and connect with trusted resources, visit AllVeteran.com today and take the next step toward securing the benefits you’ve earned.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.