The Department of Employment Services (DOES) administers unemployment insurance programs to eligible residents in the District of Columbia. This program helps individuals maintain their living standards while searching for new employment opportunities. However, we understand that it can be confusing wrapping your head around the eligibility requirements, application process, and types of benefits available.

This article discusses unemployment benefits in Washington DC.

Washington D.C. Unemployment Services

| Website | does.dc.gov/service |

| Phone | 877-319-7346 |

| does@dc.gov | |

| Apply Online | https://does.dcnetworks.org/initialclaims |

| Weekly Certification | https://www.dcnetworks.org/vosnet/LoginIntro2.aspx?enc=VG+g0eunKJP6Zrgwj8GeD0LHEFEf4gIxUUUxhh53IOA= |

| Appeal a Denial | https://does.dc.gov/page/appeals |

| Find a Local Office | Office Directory |

| Report Fraud | Insurance Fraud |

| Coronavirus Updates | dchealth.gov/COVID-19-information |

Who is eligible for unemployment benefits in DC?

In the District of Columbia, unemployment compensation is available to eligible individuals who have lost their job through no fault of their own. To receive benefits, an individual must meet certain eligibility criteria set by the Department of Employment Services (DOES).

The first criteria for DC unemployment eligibility is that the individual must be a resident of the District of Columbia. They must have been employed in the state for at least 20 weeks before becoming unemployed. Additionally, the individual must have earned a minimum wage during this period.

Individuals who voluntarily quit their job, are fired for misconduct, or cannot work due to a labor dispute are not eligible for unemployment compensation in the District of Columbia.

How do I apply for unemployment benefits in DC?

Applying for unemployment insurance benefits in the District of Columbia can be done through the Department of Employment Services (DOES) website or by visiting a DOES Career Center in person. The process is designed to be as straightforward as possible, and the following steps outline what you need to do to apply:

When you want to apply for Washington DC unemployment benefits, ensure the following documents are ready:

Social security number

Recent employer’s name, phone number, address, and employment date

Alien Registration number (for non-US citizens)

DD214 (For ex-military)

Standard Form 8 or Form 50 (For former federal employees)

Pension information (for people receiving a pension payment)

Visit the DOES website: The first step in applying for unemployment benefits is to visit the DOES website at does.dc.gov. On the website, you can access information about the program and start the application process.

Create an account: To apply for unemployment benefits, you must create a personal account on the DOES website. This account will allow you to access your benefits information, track your unemployment claim status, and receive notifications about your application.

Complete the online application: After you have created your account, you can complete the online application for unemployment benefits. You must provide information about your employment history, wage information, and the reason for separating from your job.

Submit the application: Once you have completed the application, you can submit it online. You will receive an acknowledgment of receipt, and DOES will review your unemployment claim.

Attend an interview: If additional information is needed, you may be required to attend an interview at a DOES Career Center. During this interview, you will be asked to provide additional information about your employment history and the reason for your separation from your job.

Receive your determination: The DOES will review your application and determine if you are eligible for unemployment benefits. Just like with temporary disability benefits, you will receive a determination letter with information about your benefits and how to access them.

How much unemployment benefits can I receive in the District of Columbia?

The maximum weekly unemployment benefit amount in the District of Columbia is $445, and the minimum is $44. The exact amount you can receive will depend on your prior income and the time you were employed. The total benefits you can receive during your benefit year, typically 52 weeks, is capped at 26 times your weekly benefit amount, approximately $11,570. Remember that these amounts may change, so checking the District of Columbia Department of Employment Services website for the most up-to-date information is a good idea.

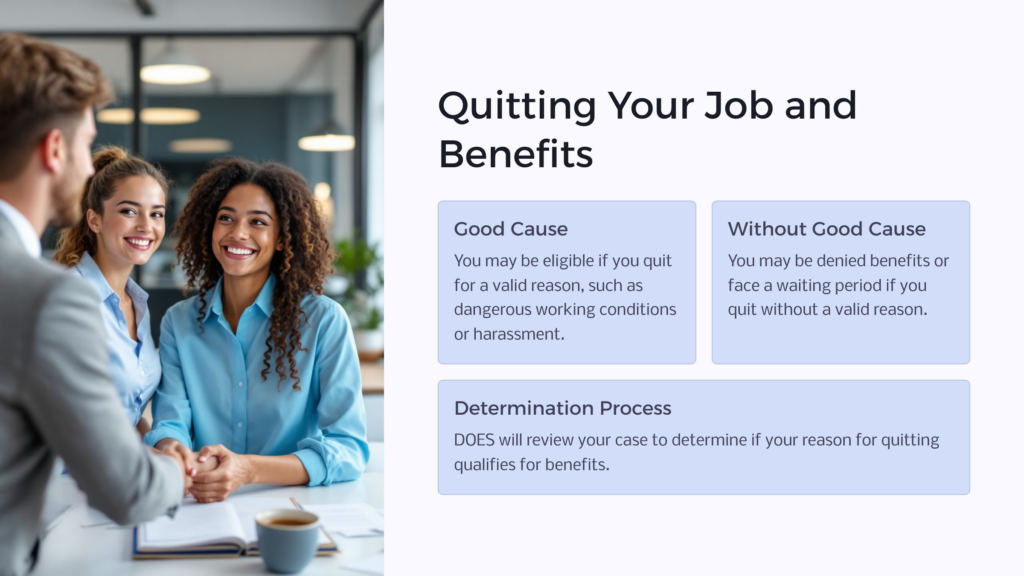

Can I receive unemployment benefits if I quit my job in the District of Columbia?

In the District of Columbia, you may be eligible for unemployment benefits if you quit your job, but only in certain circumstances. To receive unemployment benefits, you must be unemployed through no fault of your own.

If you quit your job for a “good cause,” you may still be eligible as a claimant for unemployment insurance benefits. Good cause generally refers to circumstances that make it unreasonable for you to continue working, such as dangerous working conditions, harassment, or a substantial change in the terms and conditions of your employment.

If you quit your job without good cause, you may not be eligible for unemployment benefits. In this case, your claim may be denied, or you may have to serve a waiting period before you can start receiving benefits.

Can I receive unemployment benefits as a part-time worker in the District of Columbia?

You can receive unemployment benefits if you work part-time in the District of Columbia. Unemployment benefits are available to eligible workers who have lost their job through no fault of their own, regardless of whether they were full-time or part-time employees.

To be eligible for unemployment benefits in the District of Columbia, you must have earned enough wages during a recent 12-month period, called the base period, and be actively seeking full-time work. Your earnings during the base period determine the number of benefits you are eligible for.

If you are a part-time worker and have lost your job, you should file a claim with the District of Columbia Department of Employment Services to determine your eligibility for unemployment benefits.

What happens if I make a mistake while certifying for my benefits in the District of Columbia

Correcting it as soon as possible is important if you make a mistake while certifying your unemployment benefits in the District of Columbia. Failing to report your status accurately and earnings can result in overpayments, which you may be required to repay, or even fraud charges.

If you realize you have made a mistake on your certification, you should immediately contact the District of Columbia Department of Employment Services to report and correct the error. They can assist you in correcting and ensuring that your benefits are calculated accurately.

It is important to be honest and truthful when certifying for your benefits, as knowingly providing false information can result in criminal charges and other penalties.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.