The US Department of Veterans Affairs offers several programs, services, and initiatives meant to make the transition into civilian life easier for service members. VA loans are one such offering, allowing veterans to move into a home. For veterans contemplating a VA home mortgage, it’s important to know about the Tidewater Initiative.

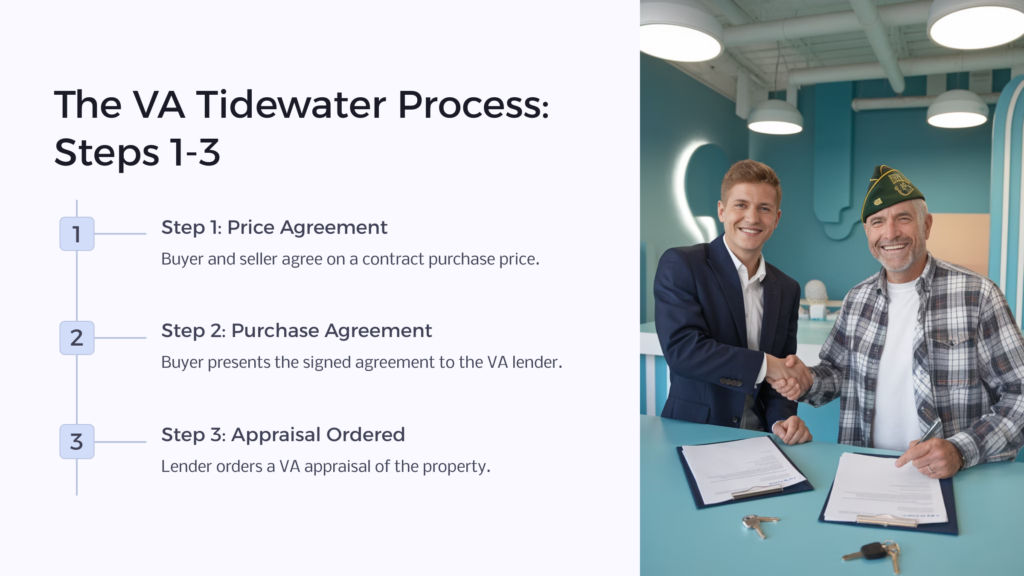

7 Steps in the VA Tidewater Process

- Buyer with VA Loan and seller agree on price

- Buyer presents purchase agreement to lender

- Lender orders an appraisal

- Appraiser can invoke Tidewater Initiative if appraisal value is lower than contracted sale price

- Point of contact notified parties involved in the sale

- Parties involved have two days to provide Appraiser with any relevant information

- VA reviews information and makes a decision

A VA appraisal for a VA home loan has two parts. The first assesses Minimum Property Requirements for health and safety standards. The second part involves a property assessment of the home value. When it comes to a VA loan (or any home loan), lenders will only offer a loan equivalent to the lower of the two values between the appraised value and the sales price. In the case of a veteran looking for a home and wanting to use a VA loan, that means the deal could fall through.

What is the Tidewater Initiative?

The Tidewater Initiative (or Tidewater for short) is used when the appraised value of a home falls below its contract purchase price worked out by the buyer and seller. In civilian home sales, the buying party is usually free to use whatever appraiser they’d like—sort of. The home appraiser must be licensed and an approved appraiser with the mortgage company. But that still leaves some room for the buyer appraiser to choose an appraiser. Civilians can also use any lender they want.

But that’s not the case with veterans seeking VA home loans. They need to do everything with the VA, including their appraisal process. This leaves little room for discussion in terms of the loan the VA is willing to offer. If they appraise the home at a value that’s too low for the seller, the deal might fall through, and the veteran buyer would be left out of luck. Thankfully, the Tidewater Initiative allows the buyer and seller to make a case for their contract purchase price.

The Seven Steps to The VA Tidewater Process

There are several steps in the Tidewater appeal process. Let’s go over one by one how you’ll need to approach your appeal!

1. Buyer with VA Loan and seller agree on price

This is the first step before anything else. Until the seller and the homebuyer agree on a purchase price, there is no potential sale. Of course, this usually involves a back and forth exchange regarding the value of the property, especially as assessed against comparable homes (comps) in the neighborhood. Usually, this process is facilitated by a real estate agent representing each side of the party and their best interests.

2. Buyer presents purchase agreement to lender

The home buyer will then bring a signed purchase agreement to the VA lender. This is a statement in good faith on behalf of the seller regarding an estimated selling price of the home. It is not a binding agreement to sell the property or transfer its ownership, just a contract locking the two of them into a deal to do so. Either party could still pull out of the arrangement before concluding it with a sale.

In many cases, if the buyer has fronted any earnest money, they could lose it to the seller should they exit the arrangement. Thankfully for VA buyers, their earnest money is protected and can be retrieved should they decide to walk away. This purchase agreement is a written sign that both parties are serious about moving forward with the sale, which means the seller will need a mortgage.

3. Lender orders an appraisal

No lender will just extend any money sight unseen. A loan officer will always want a third party to conduct an appraisal of the property. The lender does not want to extend more money than the property is worth since that would put themselves at risk.

The appraisal must be conducted by the VA through a VA appraiser. As mentioned, this VA appraiser will look at the Minimum Property Requirements of the home in regards to meeting certain living standards for health and safety. They will also attempt to pinpoint its true value by looking at comparable home sales in the same area.

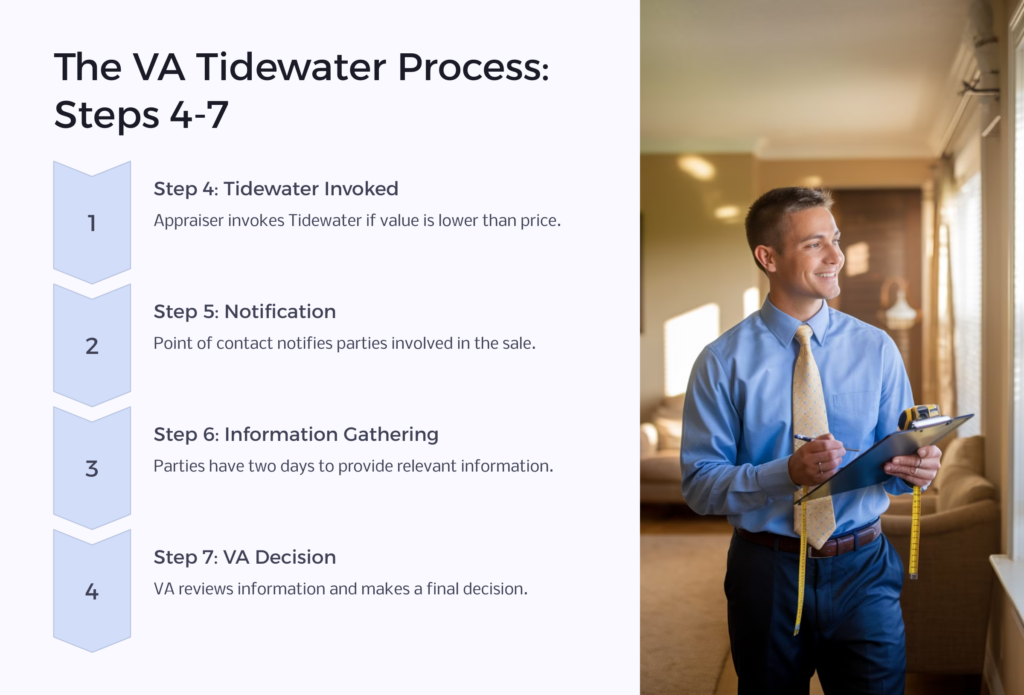

4. The VA appraiser can invoke Tidewater Initiative

But the VA appraiser (like any appraiser) may find out that the home is worth less than the contract purchase price. In fact, this is probably a fairly common scenario, given the fact that home sellers would like to make money on their home. It can also cause a sale to fall through, especially if the buyer can’t easily locate a different lender.

The good news is that the appraiser can invoke Tidewater. This is essentially a request to gather more details about the property in case any of them may change the appraiser’s assessment. Incidentally, with VA appraisals, the parties involved will not find out the actual appraised value…just whether it matches the home’s contact purchase price or falls below it.

5. Point of contact notifies parties involved in the sale

The appraiser will then notify the point of contact (POC) in the sale, which is usually the lender. The POC will then contact the real estate agent representing each party to the transaction, or in cases where the home is being sold by the owner, the owner directly.

The appraiser will then notify the point of contact (POC) in the sale, which is usually the lender. The POC will then contact the real estate agent representing each party to the transaction, or in cases where the home is being sold by the owner, the owner directly.

6. Parties involved have two days to provide any relevant information

You might think that a homebuyer would be happy to hear that the home appraises for less than its contract purchase price. After all, isn’t that a sign of approval from a third party that the seller should lower their price? Perhaps. But unfortunately, most sellers are in the game to get as much profit as possible from selling their home. An appraisal that locks them into a potentially lower price is not appealing. If the veteran is motivated to sell the home, the homeowner gets two days to look for relevant information to build their case.

This is why you want to work with an experienced real estate agent when selling your home, and probably one familiar with VA loans if you are in a military area. Such an agent is already familiar with comps in the area and two days is enough time for them to get that information together. Keep in mind that comps must be homes that have sold already, not ones that are on the market. This is because the market price does not necessarily reflect their true value. A pending sale can count, but only if the subject property is already under contract. A realtor can present evidence like comparable properties to the VA appraiser, and any other evidence.

7. VA reviews information and makes a decision

The VA appraiser will then take this information and re-examine their initial appraisal. If they find no reason to change their mind, they must issue an explanation in writing. The Staff Appraisal Reviewer (SAR) will issue a final Notice of Value (NOV) on the property, which is the bottom-line value of the home according to the VA for loan purposes.

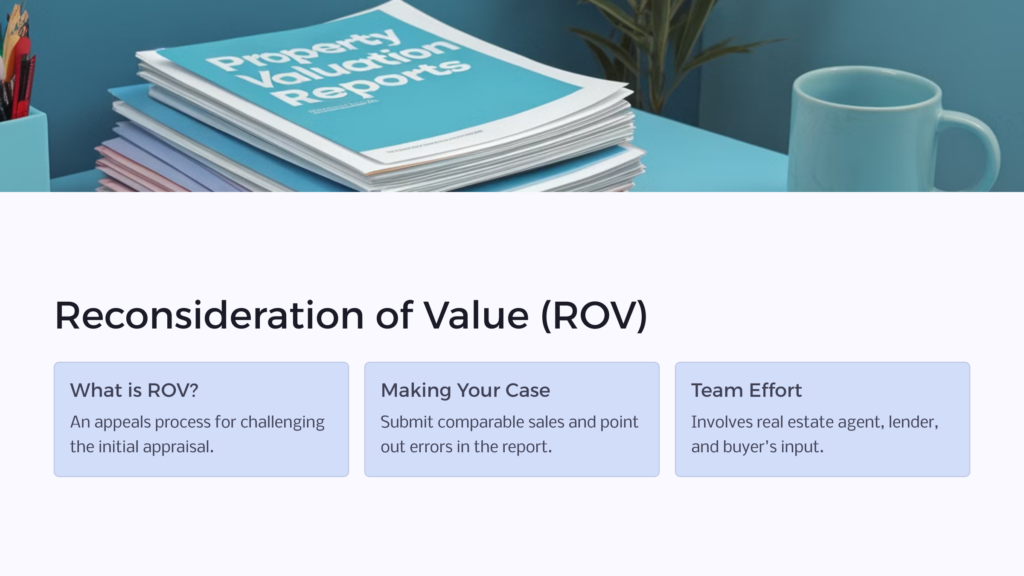

What is a Reconsideration of Value?

What if the appraiser made an honest mistake, not only by factoring dissimilar properties, but by miscalculating or omitting any value-adding features like a remodel? What if they simply miscalculated the square footage? Human mistakes are common. Fortunately, there is an appeals process for an appraisal rebuttal called a Reconsideration of Value. You will need to bring your real estate agent and lender into the conversation about how to proceed with an ROV.

There are a few ways to make your case. You can submit three comps in the neighborhood that were not included in the initial appraisal and closed before the appraisal report (in other words, homes that sold recently). They’ll need to be input into a special Reconsideration of Value grid, with printouts from the Multiple Listing Service (MLS) and a brief summary making a case as to why those comps you’re selecting are more relevant than the comps the appraiser used.

You can also point out any errors in the appraisal report, which can include making a case that the comps used by the appraiser were not like the property you’re attempting to buy. For example, you can claim that the two properties are not the same in terms of size, age, or condition. The ROV also requires a letter from the borrower with their thoughts on why the appraised value should be increased.

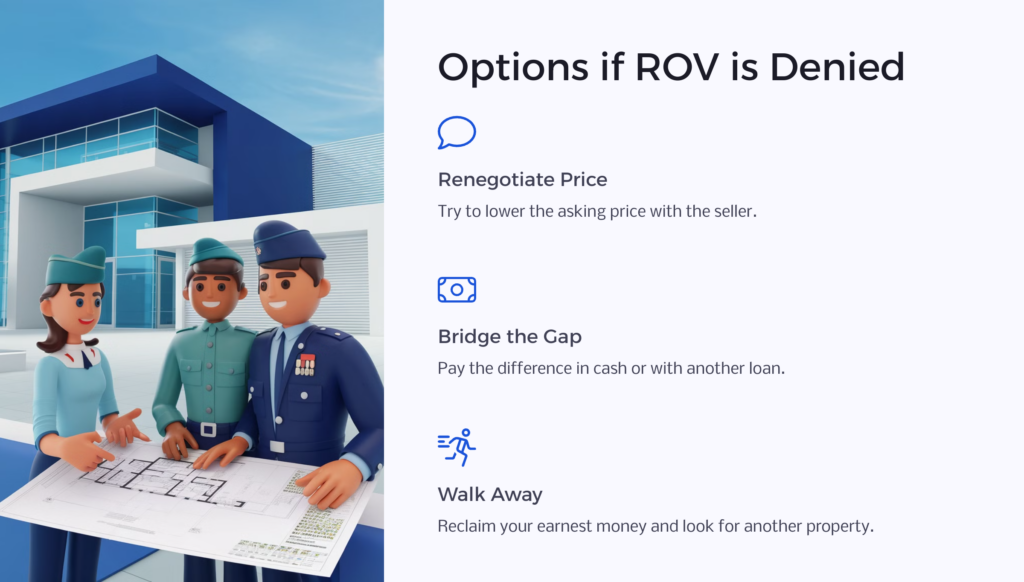

What If the Reconsideration of Value Is Denied?

Having your ROV denied may seem like the end of the road. But what if you’re really set on the property? The first thing you could do is the most obvious, perhaps: Try renegotiating the asking price with the seller. They may not go for it, but it’s worth trying. You could also just bridge the gap between the VA loan and the contract price with cash or a different loan.

If you decide to go the cash route, don’t forget to factor in your closing costs. You can also lower your VA funding fee by paying more than 5% down up front. You can also use a combination of the above options to negotiate a lower price and then make up the difference in cash. If all else fails, you can walk away from the deal, and the VA Amendment to Contract will allow you to claim any earnest money deposit you made.

Understanding the Tidewater Initiative

The VA appraisal process is not meant to make life more difficult for a VA buyer. In fact, it allows them to use comparable sales and other relevant information to change something that would otherwise be set in stone: the VA appraisal process and its outcome.

Every VA buyer attempting to buy a home with a VA mortgage will need to go through the process of a VA appraisal, so Tidewater Process is a huge boon to their home search. Such an appraisal may fall short of the contract purchase price.

In times past, this would have left the buyer a choice to walk away, ask the seller to lower the price, or pay up the difference in cash. But now with the Tidewater Initiative, buyers can contest the appraisal before it becomes set in stone, and even after it’s finalized, they can contest it.

Learn more about the hidden advantages available to you as a Veteran. We at Benefits.com are always here to help, so contact us today!

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.