The decision to retire is perhaps the biggest work-related decision a person ever makes. It’s complicated and has lots of layers – some financial, some psychological, some emotional, and even some physical. And while there’s no one-size-fits-all answer to the question, “When should I retire,” there are a few key markers you can look for that all point in the direction of a financially healthy and enjoyable retirement.

8 Signs It May Be Time to Retire

- Your retirement savings will support you

- You have no debt

- You have no financial dependents

- You have appropriate health insurance

- Your spouse is on board

- You’ve reached retirement eligibility age

- You have hobbies and interests outside of work

- You have a supportive social network

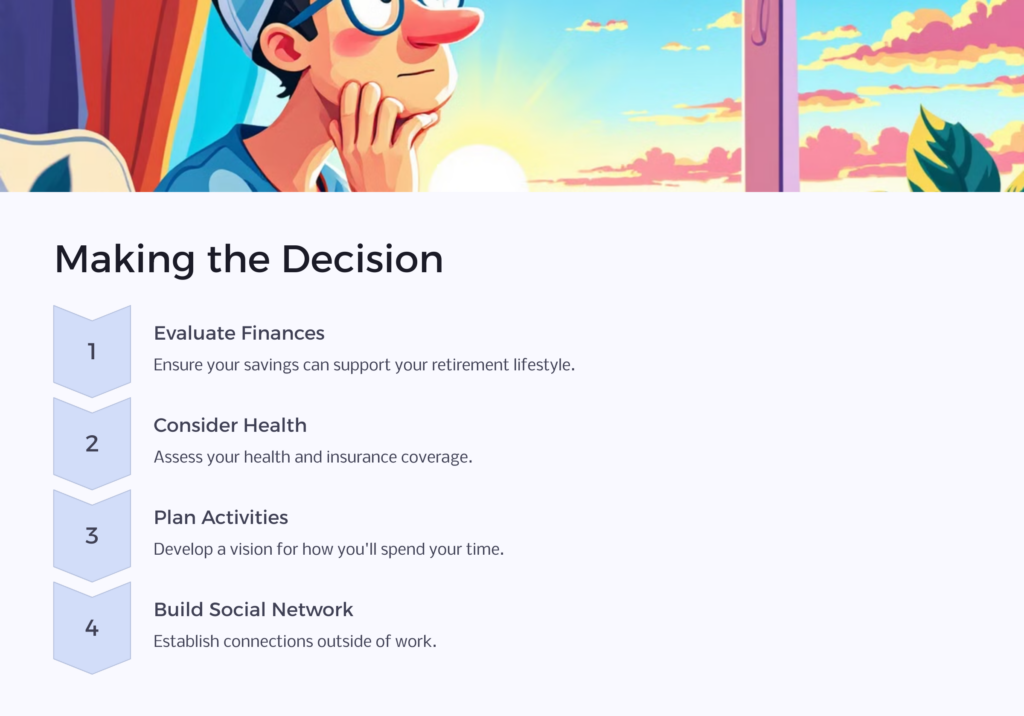

Whether you love your job or you’ve been daydreaming about retirement for years already, eventually the time comes when you need to make a firm decision about a retirement date. But setting that date can feel intimidating – retire too early and you may face a restrictive income, retire too late and your health may not allow you to enjoy it. How, exactly, do you find the sweet spot for starting life as a retiree?

While retirement expectations and satisfaction are different for everyone, there are a few important factors to help determine whether you’re ready to retire.

1. Your Retirement Savings Will Support You

There’s no magic retirement savings number that’s right for everyone. This sounds obvious, but have you sat down, made a retirement budget, and confirmed that your retirement savings account has enough money to handle it? If you haven’t, that’s an important first step – and it’s especially important if you’re considering early retirement. You have to understand what your retirement savings – combined with any Social Security retirement benefits you receive or any other supplementary income if you think you’ll work after retirement – can cover in terms of your lifestyle and life expectancy. Will you have to make major changes in your lifestyle to stretch your retirement dollars farther? Once you retire, you’ll basically be paying yourself out of your retirement account, so make sure you have enough money there to meet the monthly payment.

You can add up your fixed expenses, plus your “wants,” like travel, dining out, shopping, entertainment, etc., and examine them beside your overall income sources, including retirement plan distributions, pension benefit, Social Security monthly benefit and any other personal savings or income you might receive after retirement.

A good general rule of thumb is that your budget should never exceed 4% of your overall investments, plus Social Security income and pension income. Another recommended benchmark is that your retirement investments be approximately 25 times larger than your expected annual withdrawal. Fidelity has recommended that you’re in good shape if you’ve saved eight times your annual salary by the time you’re 60 and 10 times your annual salary by the time you’re 67. If you’re in this camp, you’re probably ready on the financial front for a healthy retirement. If not, it may make better sense to set a goal for yourself for getting there so that you can feel more confident that your overall retirement portfolio will have enough money to support you.

Make sure to talk with a financial professional about your financial plan. As you’ve approached retirement age, you should have begun moving investment income to more conservative strategies, but make sure you have a good understanding of what your nest egg looks like. If you need help determining what your Social Security retirement benefits will be, the Social Security Administration is a great resource.

2. You Have No Debt

Paying off all debts is one of the best things you can do to position yourself for a healthy retirement. If you still owe money on a home or a car, or you have credit card debt, you should consider continuing to work until all those debts are cleared. Doing so ensures that all your retirement income and Social Security retirement benefits go directly toward your current and future living expenses rather than continuing to pay for items you purchased in the past.

Since your income will be fixed in retirement, not having any debts helps you be more flexible and to respond to unexpected expenses more healthfully. While some people may choose to retain a mortgage or car payment after retirement if their income sources allow, it’s not wise to retire until you’ve cleared any high-interest credit card debt, student loans, or any other outstanding loans you may have.

3. You Have No Financial Dependents

By the time you retire, your children should be grown, out of your home, and gainfully employed. If that’s not the case, you should seriously consider deferring your retirement. The same is true if you are taking care of elderly parents financially or believe you will need to do so in the future. It’s not easy to downsize your life and minimize expenses while you also financially support others. If you still have financial dependents, take the time to look at how long that is likely to be the case. It would be wise to remain part of the workforce until no one else is depending on you financially.

4. You Have Appropriate Health Insurance

Taking care of your health is one of the best things you can do to ensure that you enjoy a healthy and active retirement. Careful consideration of your health care situation is essential when deciding when to retire. Are you in good enough health to be able to enjoy checking items off your bucket list after retirement? Or is a health care issue leading you to believe the time might be right to exit the workforce? In either case, you’ll need to make sure that you have health care insurance in place to help cover your medical expenses.

A recent Fidelity study showed that a couple in retirement needs approximately 200,000 to 400,000 to cover health care costs after retirement if they retire at age 65 – and that’s after what Medicare covers. Having a plan to help cover those expenses is a must – that may comprise a Medicare supplemental policy or private health insurance. It’s a good idea to meet with someone from your employer’s human resources team to make sure you understand your options when it comes to available health care benefits after retirement.

5. Your Spouse Is on Board

If you’re married, your retirement won’t affect only you. What are your spouse’s plans for retirement? Does it make sense for one of you to retire while the other continues working for a few years? Or would you like to retire together? What happens if one of you wants to move to the mountains, while the other would like an apartment in the city? How will the two of you spend your days during retirement? These are important conversations you and your spouse must have before making a final decision.

When you agree on everything from your financial situation to the expectations of your life after retirement, it will make the experience so much smoother for everyone.

6. You’ve Reached Retirement Eligibility Age

While your age alone isn’t sufficient to determine whether you’re ready for retirement, it’s certainly a factor. According to the Social Security Administration, full retirement age for those born between 1943 and 1954 is 66. For those born after 1959, full retirement age is considered 67. If your health is good and you haven’t yet reached the average retirement age, you may be better off to continue working and defer your retirement until you reach the appropriate age. While you can begin collecting Social Security retirement benefits as early as age 62, the longer you wait to collect those benefits, the higher your monthly income will be. Make sure to consider this if you’re planning for early retirement.

On the flip side, older workers that defer retirement until age 70 can receive up to 132% of the monthly benefits they would have received if they’d begun collecting as soon as they reached normal retirement age.

7. You Have Hobbies and Interests Outside of Work

What will you do with your time once you’re a retiree? Don’t wait to answer this question until after you retire. It’s important to have a vision of what your life will be like post-retirement. You need a purpose for how you’ll spend your time and resources – home projects, travel, volunteer opportunities, more social activities, etc. It’s not enough to want to retire just to quit your job – you need a clear path for how you’ll fill your days with purpose moving forward. It’s important not to make the mistake of confusing an unsatisfying job situation with a true desire to exit the workforce completely. You might want to ask yourself if you’d be happier making a career change than retiring.

What will you do with your time once you’re a retiree? Don’t wait to answer this question until after you retire. It’s important to have a vision of what your life will be like post-retirement. You need a purpose for how you’ll spend your time and resources – home projects, travel, volunteer opportunities, more social activities, etc. It’s not enough to want to retire just to quit your job – you need a clear path for how you’ll fill your days with purpose moving forward. It’s important not to make the mistake of confusing an unsatisfying job situation with a true desire to exit the workforce completely. You might want to ask yourself if you’d be happier making a career change than retiring.

You can even try a test run. Take some vacation time and “practice” what your retirement life might be like. Volunteer. Travel. Do some consulting on the side to determine whether working after retirement might be an option for you, both as a way to focus your energies and to supplement your income. Relax. See if you can picture yourself living this life over the long term.

Many people who don’t take the time to establish a vision for post-retirement life often find themselves aimless and disappointed with their decision – some even decide to either go back to full-time work or to take on a part-time job after retirement. But if you have a bucket list and a clear idea of how you’ll check off all those items, you’re well-positioned for a meaningful and fulfilling retirement.

8. You Have a Supportive Social Network

We often identify with our professional roles, and during our busy years in the workforce, it’s easy for our primary social interaction to be with our colleagues. Before you retire, though, it’s important to make sure you have social outlets and connections in place outside of your work. Whether that’s a faith community, an existing network of friends, volunteer engagement, or some other outlet, you’ll need to replace the social community you formed as part of your job in order to remain psychologically engaged and healthy.

Signs It’s Time to Retire

The decision to retire can be complex and involves a lot of different moving parts. It isn’t as simple as setting a target age or a target retirement portfolio amount. While those are certainly important, you must also make sure that you’re physically, emotionally, and psychologically ready for retirement. You must give the decision the time, attention, and thoughtfulness it deserves.

Several key indicators can help you understand if you’re comprehensively healthy and ready for a fulfilling and comfortable retirement. If you take some time to carefully go through the recommendations listed here, you can go a long way toward objectively evaluating your readiness for retirement. If you feel confident you meet all the criteria here, it may be time to get started on your next new adventures as a retiree.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.