A Continuing Disability Review (CDR) is a periodic review by SSA to assess whether a person who was previously found disabled under SSDI or SSI still meets the medical eligibility requirements for disability benefits.

Types of Continuing Disability Review

Full Medical Review

Triggered if:

- Medical improvement is expected/possible

- Red flags are detected (e.g., return to work, jail, no medical treatment)

SSA Sends:

- Form SSA-454 (Continuing Disability Review Report)

- Requests medical records, function reports, and sometimes CE exams

Mail-In “Work CDR” or SSI Redetermination

Used when the primary concern is:

- Income, work, or resources, not medical improvement

SSA Sends:

- Form SSA-455 (Disability Update Report) — short form

- Based on answers, may convert to a full medical review

CDR Medical Evaluation Process

SSA evaluates using a modified version of the 5-step process:

- Are you working at SGA level?

- Have you had medical improvement?

- Is the improvement related to your ability to work?

- Do you still meet or equal a Listing?

- Can you do past work or other work, based on your current limitations?

Possible Outcomes of a CDR

| Outcome | Meaning |

| Benefits Continue | No medical improvement or still meets disability standards |

| Cessation Proposed | Medical improvement found; claimant no longer meets criteria |

| Appeal Available | Claimant may file for reconsideration, ALJ hearing, or continue benefit during appeal if requested timely |

Appeals Deadlines After CDR Cessation

10 Days: To request monthly benefit continuation while appealing

60 Days: To request reconsideration

Appeals follow a process similar to an initial claim (reconsideration → ALJ → Appeals Council → Federal Court)

How to Prepare for a CDR

Keep consistent medical treatment, request updated RFC forms from treating physicians, keep records of ADLs and functional limitations, and avoid gaps in treatment unless justified. If you are working, be sure to document any accommodations or unsuccessful work attempt. All in all, the key is to be as thorough with your information as possible.

Continuing Disability Review (CDR) Preparation Checklist

Paperwork & Forms

- Received SSA-454 or SSA-455 form

- Review all prior Award Notices and ALJ decisions (know the basis of original approval)

- Make a copy of all documents before submitting

Medical Documentation

- Secure recent medical record (within the last 12 months)

- Request updated RFC/Medical Source Statements from treating providers

- Keep medical evidence: ensure notes document frequency, duration, and severity of symptoms

- Ask providers to clearly state if the condition has not improved

Treatment Consistency

- Ongoing appointments with specialists/PCP for medical condition

- Medication compliance documented (or reason for non-compliance explained)

- Any gaps in treatment explained (insurance, COVID, etc.)

- Mental health: therapy, psychiatrist notes, hospitalizations if applicable

Function & Daily Activities

- Prepare ADL report or third-party statement (impact on daily life)

- Document changes since initial approval (better, worse, or unchanged)

- Avoid contradictions between ADLs and claimed limitations

Work & Income

- Working? Provide full earnings summary and job duties

- Secure evidence of:

- Accommodations or reduced hours

- Unsuccessful Work Attempts (UWA)

- Report any vocational rehabilitation participation or outcomes

Deadlines & Appeals

- Calendar the 10-day window to request benefit continuation (if applicable)

- Know the 60-day deadline to appeal a cessation

- Prepare for reconsideration hearing (CDR-specific) if needed

Best Practices

- Keep copies of everything submitted

- Use certified mail or online submission for proof

- Educate client about what “medical improvement” means

- Track SSA contact attempts or CE appointment requests

Is an Attorney Needed for a Continuing Disability Review Hearing?

You are not required to have a disability attorney but having one can make a big difference — especially if SSA plans to stop your benefits and you’re appealing that decision.

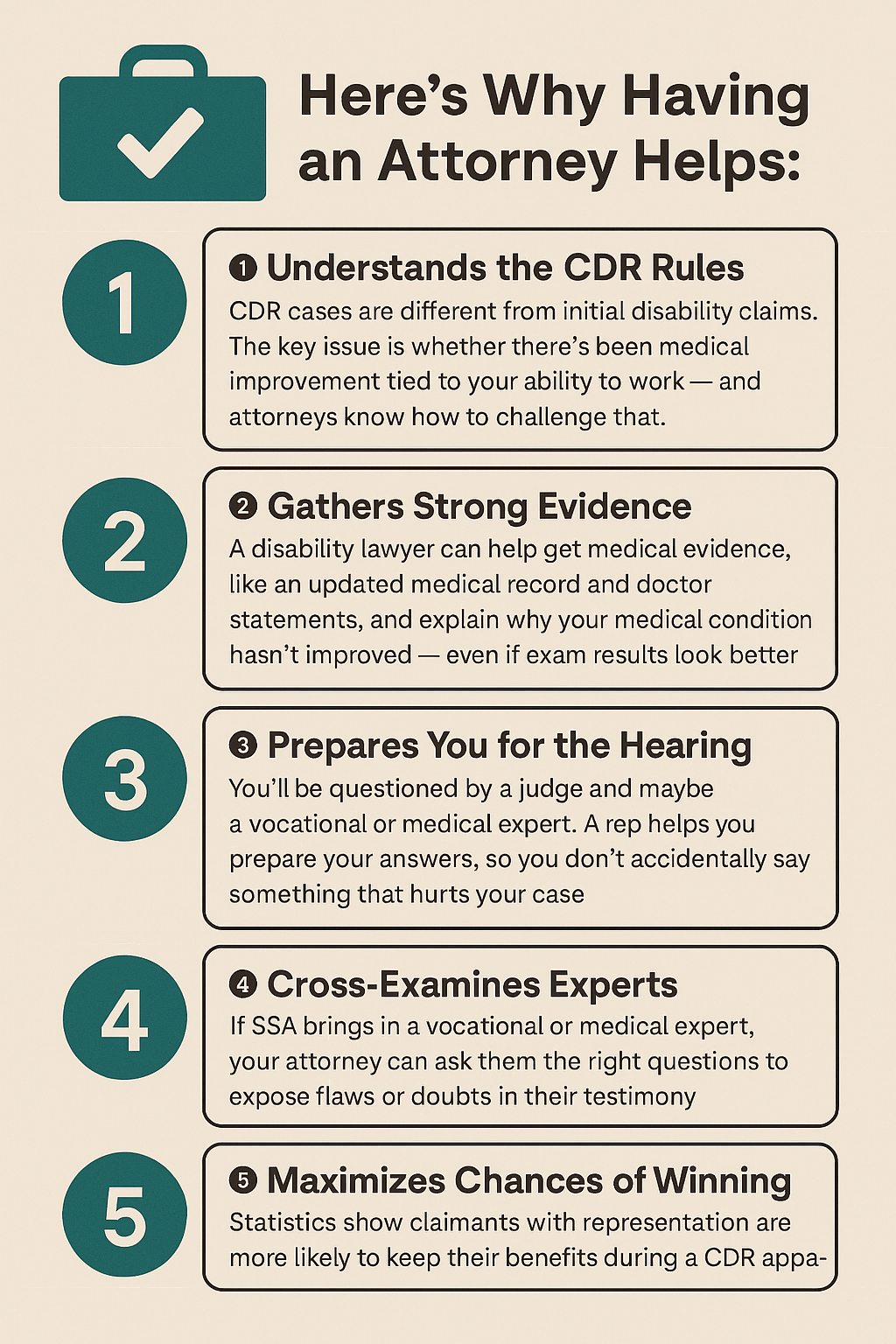

Here’s Why Having an Attorney Helps:

Understands the CDR Rules

- CDR cases are different from initial disability claims.

- The key issue is whether there’s been medical improvement tied to your ability to work — and attorneys know how to challenge that.

Gathers Strong Evidence

- A disability lawyer can help get medical evidence, like an updated medical record and doctor statements, and explain why your medical condition hasn’t improved — even if exam results look better.

Prepares You for the Hearing

- You’ll be questioned by a judge and maybe a vocational or medical expert.

- A rep helps you prepare your answers, so you don’t accidentally say something that hurts your case.

Cross-Examines Experts

- If SSA brings in a vocational or medical expert, your attorney can ask them the right questions to expose flaws or doubts in their testimony.

Maximizes Chances of Winning

- Statistics show claimants with representation are more likely to keep their benefits during a CDR appeal.

Get The Help You Deserve: Lawyers Are Accessible

You can represent yourself, but if your benefits are at risk, having an experienced disability attorney or representative is strongly recommended.

A CDR can feel overwhelming — especially if Social Security says your benefits might end. While you’re not required to have an attorney, having one on your side can greatly improve your chances of keeping your benefits. They understand the system, know how to build a strong case, and will stand up for you at your hearing. If your health hasn’t improved and you still can’t work, you deserve to have someone fight for you.

At Benefits.com, we are here to help you navigate the process and receive the benefits you deserve. Begin today by taking our free eligibility quiz.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.