The federal government funds the SSI program to provide income support to qualified individuals aged 65 and above, disabled or blind, including eligible disabled or blind children.

Conversely, the California government funds the SSP program, which augments SSI and their total benefit amount.

However, both SSP and SSI payments are administered by the Social Security Administration (SSA). The SSA determines who qualifies for both programs using federal criteria.

Individuals who qualify for SSI will qualify for SSP, and both benefits are rewarded as cash assistance. Read on to find out how to apply for SSI.

What types of people qualify for SSI?

SSI is specifically for people who cannot work because they are above 65 years old, blind or disabled.

The SSA California list of qualifying conditions is contained in the Bluebook. This book lists the SSI’s definition of impairments that qualify for SSI.

The book is created for attorneys, health professionals, and social security disability experts because it contains technical terms that are difficult for the general public to comprehend. Discuss with a doctor about the listings and how they can affect eligibility.

Is it hard to apply for SSI in California?

Applying for SSI in California is easy but requires upfront knowledge of the process.

Contact a medical professional to confirm if your condition is eligible for SSI. Proof your eligibility by getting a doctor’s report of your severe physical or mental disability that prevents you from working.

You can contact your regular physician, but visiting a medical doctor with experience with the bluebook can help boost your chances of approval.

To get approved for SSI, you must confirm that you cannot do any work at all, not just your job.

For instance, your previous job may involve heavy lifting. But you can no longer do the job after an accident that affects your spine. If there’s a desk job that doesn’t require heavy lifting, Social Security may reject your application.

SSI is a need-based program, so you may not qualify if you still earn monthly income. In 2021, you were expected to earn less than $1,170 per month but this amount is usually adjusted yearly.

The SSA evaluates the applicant’s responsibility and the number of work hours to determine if the income limit qualifies for SSI. Keep bank statements and pay stubs because SSA may need to confirm your income.

Evaluate your resources

Besides low income, SSA also checks assets that can be sold for cash to cover bills and medical expenses. These assets include real estate, investments, and physical properties. To qualify for California SSI, countable resources must be less than $2,000 ( and $3,000 for married applicants).

Excluded resources don’t count

The SSA does not ask applicants to sell everything before they can qualify for SSI. Resources like homes and cars don’t count for resource limits, irrespective of their worth.

Also, household items like clothing and furniture do not count. Every resource used during a business does not count for self-employed applicants.

For instance, if you use a P.C. to work from home, your computer does not count.

Examine citizenship requirements

U.S. citizens and lawfully permitted residents can qualify for SSI. Gather all necessary information that confirms your U.S. citizenship or legal residence in the country.

Be prepared to present social security cards and birth certificates. Applicants may also be required to present their U.S. passports.

Applicants who became U.S. residents because they were granted asylum or entered as refugees may qualify for SSI under certain circumstances.

Get in touch with your county social service office for further assistance.

California social service includes SSI advocacy as part of their support service for adults. A social worker can help you gather the necessary documents and complete your application.

Social workers will also evaluate your condition and requirements to see if you qualify for other local and state programs to ensure you get every assistance you are eligible for.

Feel free to reach out to your county social service office online.

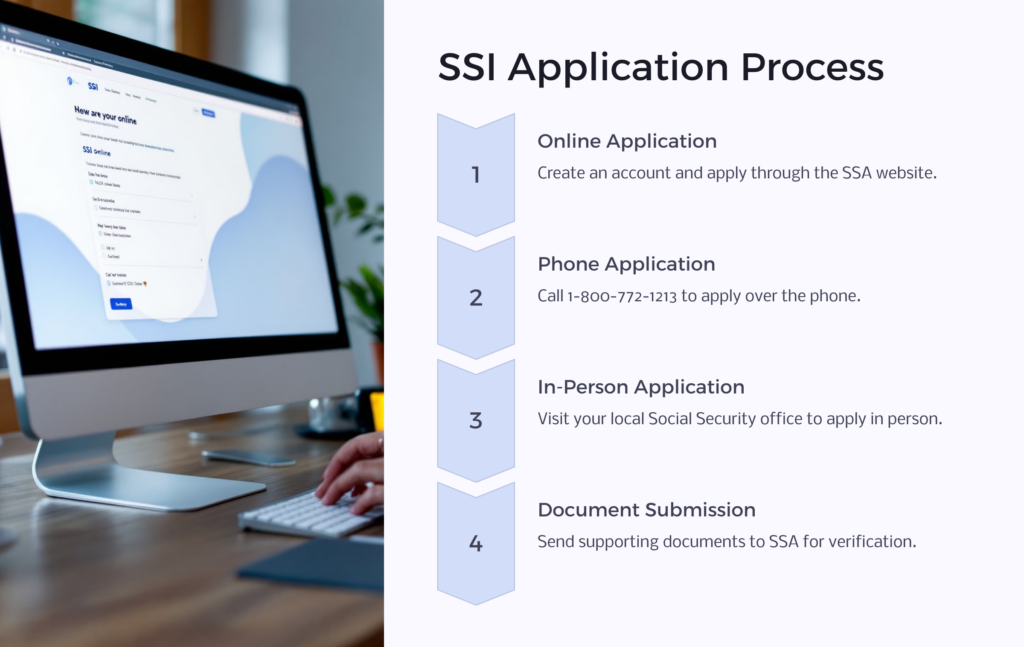

Can I apply online?

You can apply for SSI disability online. The process may take a few hours, but you can save the filled Form and continue later.

Make sure you create an account so you can always check your application status whenever you want.

Some applicants are not accepted to process their applications online. For example, individuals under 18, those already receiving benefits from other programs, or those whose applications have been recently rejected are required to apply in person. Head to the nearest social security office if you don’t want to apply online.

If you’re uncomfortable applying online, you can also apply in person.

Check the nearest social security office and enter your zip code.

Put a call through to the office and schedule an appointment for your SSI registration.

Furthermore, you can request an application by putting a claim through to 1-800-772-1213. You’ll receive a paper application from social security via email.

Send Supporting Documentation To Social Security.

Social security will still need to verify the information provided in your application when applying online. You can mail SSA these documents using the address displayed on the application form.

Write your social security number on a different paper and add it to the envelope enclosed in your document. Avoid writing your social security number on the document. SSA will mail back your documents to you once they’re verified. If you’re not comfortable mailing down your document, kindly visit the nearest social security office and have them submitted in person. An admin will review your documents for verification and send them back to you immediately.

Contact the California social service agency if you need help faster. It may take up to 6 months for SSA to process your application.

The California social service agency can help find local and state resources to assist you during the duration of the application review.

When you visit or call social security services, they’ll connect you with a social worker. Your social worker will request information about how to help you. They’ll use the information to find the right assistance program for you.

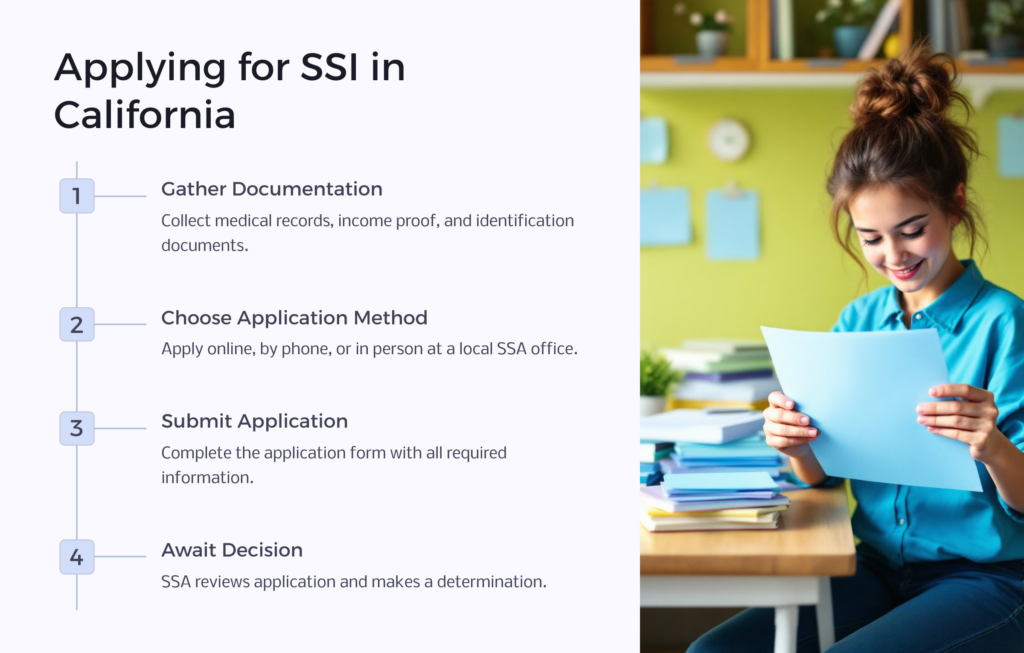

Before commencing the application process, ensure all information and documents required to fill out the application form are ready. This will help you save time, especially if processing your application online. The SSA offers a checklist which you can find here.

Go through the checklist to see the information and documents you need.

You must present the bank statement or pay stubs to confirm your income, birth certificate, social security card, and passport to confirm your identity. In addition, you may be required to provide a marriage certificate or divorce decree.

How do I apply for SSI in California?

There are 3 ways applicants can apply for SSI in California.

- Apply online

- Put a call through to social security at 1-800-325-0778 or 1-800-772-1213, and staff will follow up with your application.

- You can head to your local social security office and apply physically.

Regardless of the method you choose, be sure to have this information ready:

- Name, phone number of doctors, addresses, clinics, and hospitals where you received medical treatment, and the treatment date.

- Names of the medications you’re using

- Copies of your medical records

- You and your spouse’s social security number and any child under 18

- Your birth certificate

- Proof of U.S. citizenship

- A documented copy of your military discharge papers (if you’re in the military).

- Your tax return information, W-2 Form

- A summary of the jobs you did in the last 15 years.

Do I have to pay a fee to apply?

You have the right to apply. Anyone can apply for a social security supplement at no cost.

Your application form will be completed based on the information you submit to SSA.

SSA will help you acquire the documents you need to prove that you meet their requirements.

If you’re applying for SSA because you’re disabled or blind and don’t have the required medical information, they will pay you to perform your medical test or exam and help you schedule the appointment.

You have to do the test or exam before SSA can determine whether you qualify for SSI or not.

In addition, you have the right to use a representative.

You can hire a representative to assist you with your SSI claim and come along with you to visit the social security admin.

What should I know before applying?

Millions of Americans apply for disability benefits every year, and only a few of these applications are approved. If you’re planning to apply for disability benefits, you may not want to keep the following things in mind.

Am I disabled enough to apply?

This question may be challenging to answer. As mentioned earlier, SSA crafted an impairment listing manual known as the blue book, which listed the physical and mental conditions that qualify an individual for SSI benefits, as long as the applicant meets the criteria for this listing.

However, the SSA’s blue book does not contain some health conditions that lead to disability. If the book does not list your health condition, or if you suffer from multiple health issues, your condition may match a particular listing in the blue book.

To qualify for these benefits, your condition must be so severe that it disrupts your daily activities and job. You’ll be required to provide substantial evidence, especially a medical record, to support your claim.

Is my condition severe enough to stop me from working for 12 months?

The SSDI program is strictly a disability program, meaning that individuals who are proven 100% disabled will receive financial awards.

Disability applicants must provide valid evidence that proves the severity of their condition and how it has prevented them from getting back to work for at least 12 months.

Although you may think you’re disabled, if you can get back to work within one year, SSA will reject your claim.

For instance, if you had a knee or hip replacement unless you had unusual complications, you may likely qualify for SSDI awards.

Will I be able to start working in any way?

One of the biggest questions you have to ask yourself is whether you can work at your job or if you’re able to adjust to less stressful work.

If you don’t meet the blue book listing, SSA may set up a medical-vocational allowance.

First off, SSA will evaluate your Residual functional capacity (RFC) or what you can do with your condition. They’ll use your RFC to determine whether you can do your previous work or do a new one. Asking yourself if you can perform any task will help you decide if you should apply for SSDI.

Is my work history eligible for SSI?

The SSA must have awarded you the “insured” status to qualify for SSI benefits. The SSI program is available to someone who has paid FICA taxes Into the program during their working years.

To get approved for SSI benefits, there is a certain amount you must have contributed to the system, which depends on your age and year of work. In addition, you must have worked for a particular number of years in the last. The SSA will also access your work credit or the measurement unit that determines if you’re eligible for disability benefits. SSI will deny your application if the tax contributed to the system is low.

How Do I appeal a denial?

Get your notice from social security.

Between 3 to 6 months from the day you submit your benefits application, you either get approval or a denial letter.

If you receive a denial letter, it’ll explain the reasons for your denial and provide information on how to appeal the denial.

You have about 60 days from the denial state to file an appeal.

SSA will also check if you can qualify for social security Disability insurance (SSDI), which is different from the SSI program.

You may even receive an SSDI denial before the SSI letter. Medical proof is usually the most common reason for application denial.

The SSA may claim that you have a reasonable monthly income or have a lot of resources, or they may want more evidence of a qualifying disability.

File a reconsideration request

The first step in the appeal process is reconsideration-Call 1-800-772-1213 to receive the reconsideration form or complete it from their online platform.

The Reconsideration appeal does not require a visit to the social security office or a judge. A new SSA official who was not involved initially with your application will recheck your information and see if you’re eligible for SSI.

You can also send additional information or documents when filing a request for reconsideration.

Review your denial message and see if adding extra documentation can help. For instance, if your application got denied because social security said your condition is not bad enough to stop you from working, you can contact another doctor to reevaluate.

Request for an appeal hearing if SSA denies your appeal. Your reconsideration is usually rejected if your initial application is rejected. You may have to wait for a few months to get a response to your reconsideration request.

When you receive the notice, SSA will give you another 60 days to file for an appeal. This time, the appeal will be a hearing with a judge called the Administrative law Judge.

Like a typical request for reconsideration, you can request a hearing online or complete a paper form and mail it in.

Contact an attorney

You have a higher probability of getting your application approved if you use the service of a disability attorney. Consult an attorney with experience in social security appeals. Most disability attorneys start with a free consultation. This is an opportunity for you to create a strategy for appeal and to understand the process.

Be available at your hearing

Hearing before an ALJ is like a courtroom trial. There’ll be an SSA representative who will give detailed reasons for your application denial. This is also an opportunity to explain why you think SSA’s decision was wrong.

Feel free to submit papers to back up your claims, including calling witnesses like your doctor, who may come and confirm the severity of your disability.

Have the Appeal council review you

claim

If ALJ denies your SSI application, there’s still hope. The social security appeals can still review the decisions of the ALJ. Either they upload the decision of ALJ, take a decision themselves, or send the case back to ALJ along with proceeding instructions.

If you use the service of a lawyer, they’ll handle the appeal process for you. As with other appeals, complete a form from SSA or from online. If the Appeal Council judges against you, discuss filing a federal court lawsuit with your attorney. That should help.

For how long can I get SSI benefits?

You’ll continue to get SSI benefits as long as you’re disabled and meet the eligibility requirements, such as income and resources.

Social security will continue to check from time to time to confirm your eligibility. A medical Continuing Disability Review (CDR) contains to verify if you still meet the SSA definition of disability. A redetermination examines your resources, income, and living arrangements.

Does my income influence my SSI benefits?

If you receive income from other sources, it’ll reduce the number of your SSI benefits. Social Security handles income from some sources differently than other sources. The amount of your countable income (earned and unearned income)/reduces your SSI benefits. Earned income is the money you get paid from your job. They include wages, salaries, bonuses, tips, and other rewards for your physical or mental work.

Unearned income is any other money: the money you receive as assistance. An example is disability benefits such as long or short-term disability benefits insurance, workers’ compensation, VA benefits, income from an investment or a trust, profits, dividends, or money received from other sources except for work.

What will happen to my monthly SSI benefits payment if I move into a medical facility (like nursing homes and hospitals)?

If you live in a medical facility where Medi-Cal pays over 50% of your care, your SSI benefits may be around $56 per month for individuals and $122 for couples.

How do I handle a change in living or income arrangement?

You have to report any changes. Factors that determine the monthly SSI benefit amount may include:

- Earned income

- Unearned income

- Living arrangement

If there is a slight change in any of these, then you have to:

- Contact social security to report the change. Make sure you report the changes that happened in the month within the first 10 days of the following month to prevent overpayment.

- Report the changes to California social security service via phone, email, or in person.

What should I do if I disagree with an overpayment notice?

If you got overpaid and cannot pay back the overpayments due to your current expense, request a waiver of the overpayment.

Put a call through to social security at 1-800-772-1213. You don’t need to repay the overpayment if you’re granted the waiver.

Check us out at Benefits.com and take our quiz so we can get started helping you on your path to receiving benefits.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.