Around 38% of people get approved for disability benefits on their initial application. The Social Security Administration (SSA) has specific requirements for deciding a person’s eligibility. Meeting these standards is a strong sign that you will be approved for disability in most cases.

If you have a medical condition that’s expected to last for more than a year or creates severe complications that may result in your death, you may be eligible for disability compensation. This guide will explore five signs that may result in disability approval and how you can properly prepare your application.

Table of Contents:

What Are the Eligibility Requirements for Social Security Disability?

What Are the Signs You Will Likely Be Approved For Disability?

What Are the Chances of Being Approved for a Disability?

The Role Of A Disability Lawyer

What Happens If Your Disability Claim is Denied?

Learn More about Your Disability Approval Chances

What Are the Eligibility Requirements for Social Security Disability?

The SSA looks at a person’s work credits, work history, and the severity of their medical conditions to determine eligibility for benefits. These requirements vary based on your age range. For example, a person under age 24 needs one and a half years of work history and at least six credits.

You earn work credits by contributing portions of your paychecks to the federal Social Security trust fund. You can earn up to four credits annually if you make regular payments. If you earn $25,000 per year individually or $32,000 per year filing jointly, you’ll have to pay Social Security taxes.

The SSA previously required applicants to account for the last 15 years of their work history. However, the “five-year rule” for Social Security Disability Benefits (SSDI) reduced this number to five years, which expedites the application process.

While every case is different, you’re more likely to get your disability application approved and receive Social Security benefits if you have sufficient medical evidence documenting your disability. Submit the following comprehensive medical reports and records to strengthen your claim:

- Diagnostic reports

- Your medical history

- CT scans and X-rays

- Prescription documents

- Description of treatments.

Each medical record and report must be accompanied by signed documents from your doctors confirming the authenticity of every diagnostic test.

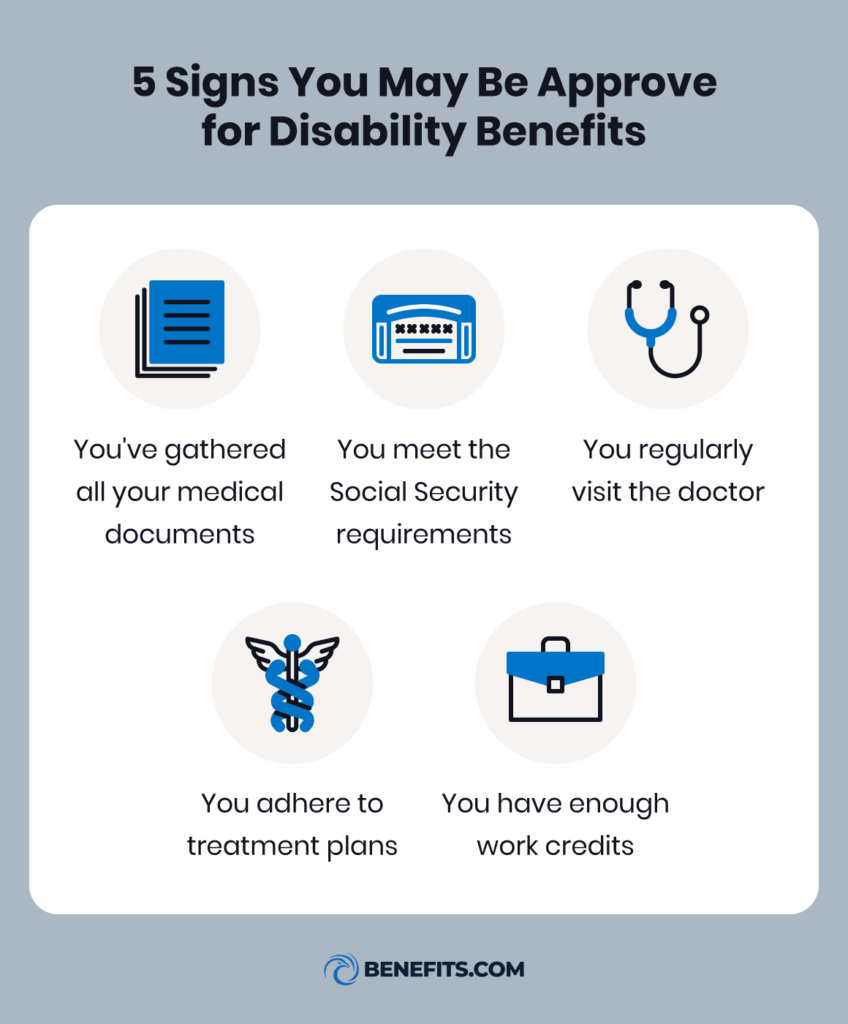

What Are the Signs You Will Likely Be Approved for Disability?

While the decision largely depends on the SSA, certain signs might suggest higher chances of approval for disability benefits. Below, we explore some of the green flags that can help indicate whether you will be approved for disability.

1. You Have In-Depth Medical Documentation

Substantial medical documentation is one of the most crucial factors in an SSDI benefits claim because it helps determine the severity of your condition. The Department of Veterans Affairs (VA) also relies on documentation to determine VA ratings and disability pay rates.

A disability lawyer is familiar with the medical evidence the SSA wants and can recommend which documents to request from your doctors. Making sure the most relevant information is sent to the SSA is beneficial to advancing your claim.

2. You Meet the Social Security Administration’s Definition of Disability

You must have a condition that qualifies as a disability in the SSA’s terms. Thoroughly review the eligibility criteria for SSDI and establish that you meet the requirements to enhance your claim.

The Social Security Administration considers these factors when establishing if you have a qualifying health condition:

- Your disability hinders you from engaging or working in substantial gainful activity (SGA).

- Your ailment prevents you from doing your previous job or adapting to complete new tasks.

- You will or have had the condition for at least one year, or it’s considered a terminal condition.

3. You Visit Your Doctor Consistently

Before applying for disability benefits, schedule an appointment with your primary care doctor and discuss your claim. Ask your provider to share medical records, laboratory test results, and written statements about your medical condition.

Veterans should also ask about nexus letters, which can tie their disability directly to their military service.

Continue to regularly visit your doctor to establish a documented timeline of your physical and mental condition. The SSA might ask for a consultative medical examination with an independent medical professional after you apply. Consistently seeing your healthcare provider can help you prepare for this exam.

Visiting a specialist can also drastically strengthen your claim. This indicates that your condition requires the utmost care and support from medical professionals and the government. Individuals with a chronic illness, such as arthritis or multiple sclerosis, have a much higher chance of getting approved for benefits if they provide the proper documentation.

4. You Follow Prescribed Treatment

Seeking medical treatment and maintaining prescribed treatment plans can strengthen your claim. It shows you’re doing everything you can to recover and get better. Failing to do so may prompt the SSA to deny your claim.

Based on your condition, prescribed treatment might also involve physical therapy, lifestyle changes, and dietary adjustments.

5. You Qualify With Your Age and Work History

Your eligibility for SSDI benefits may increase as you age. Age is a vital factor the SSA considers when determining your eligibility for compensation and your ability to work. SSDI benefits are only available for sick and injured individuals with employment history. You can’t receive disability compensation if you never paid Social Security taxes or worked.

The SSA looks at your employment history, the work credits you’ve earned, and the date your disability began. They’ll then use that information and the number of credits you’ve accumulated to determine if you’re eligible for disability benefits.

Put simply, you have a higher chance of securing SSDI benefits as you get older. The SSA prioritizes applicants who are in their 50s or 60s since they might have greater difficulty finding and maintaining employment or gaining new skills that are integral to the workforce.

What Are the Chances of Being Approved for a Disability?

Your age, condition, and work history all affect your chances of being approved for SSDI benefits. Approval ratings fluctuate across the U.S. due to factors like a state’s demographics and economy. For example, a state with an older population is more likely to have a higher approval rate as more applicants meet the SSA’s requirements.

In 2022, Hawaii had the highest approval rate at 78%, while New Mexico had the lowest at 46%. Relative to their population sizes, over 19% of Hawaii’s citizens were 65+ in 2022, while 17% of New Mexico’s population was in that age range.

Moreover, disabilities that limit mobility or are chronic or terminal are more likely to be approved by the SSA. Conversely, mental health conditions are relatively harder to get approved for. One exception is post-traumatic stress disorder (PTSD) that’s linked to a veteran’s military service.

It takes the SSA seven to ten months on average to approve or deny an application for benefits. If your claim is denied, it might be prudent to contact a disability lawyer.

The Role of a Disability Lawyer

Disability lawyers know the procedures and laws to follow while applying for SSDI benefits. They can also guide you as you fill out the application and file it with the SSA. In addition, they can help you gather all the relevant medical evidence to prove your condition hampers your ability to work.

On average, disability lawyers can charge up to 25% of a client’s back benefits or about $7,200. This fee may be well worth the cost, as disability lawyers know the ins and outs of the SSDI program and how to present a compelling case for you. Working with a professional can make waiting for SSDI approval less daunting.

What Happens If Your Disability Claim Is Denied?

If your claim was denied, that doesn’t mean you don’t qualify to receive disability benefits. There are many steps you can take to challenge the SSA’s initial decision. Here are four crucial steps to take to get the disability benefits you deserve:

The Reconsideration Process

If the SSA denies your claim, you’ll receive a letter informing you of the reasons for their decision. You can request a reconsideration for medical and non-medical reasons and have the SSA review your entire file.

You need to request a reconsideration within 60 days of receiving a denial letter. A Disability Determination Services rep not involved in determining your initial application will review your claim and make a decision. Although some claims get resolved through the reconsideration process, it’s rare.

The Appeal Hearing

If your claim is rejected after you request a reconsideration, you can appeal and request a hearing with an administrative law judge (ALJ). The hearing will occur over the phone, in person, or video conference.

During this court proceeding, the ALJ will review your medical evidence and might question witnesses, like vocational experts or medical professionals. You have two months after receiving the reconsideration decision to file for an appeal hearing. Having a disability attorney at your appeal hearing can benefit your claim for disability benefits.

Appeals Court Review

You can also request that the Appeal Council reevaluate the ALJ’s decision. However, the council can only proceed through the appeals process if they find a Social Security regulation or law issue. The Appeals Council can either refer your claim back to the ALJ or make a decision. Again, you have two months from receiving notice of the ALJ decision to file for reevaluation.

Federal Court

If all other options fail, you can file a lawsuit in the United States District Court. Again, you must file your lawsuit within two months of receiving notice of the Appeals Council’s hearing decision.

| “If you’ve been denied and you disagree with SSA’s decision, you should appeal the denial within 60 days. In your appeal, you should note any doctors or other medical providers you are continuing to see, or any new ones that you didn’t include in your initial application.” |

| Merrick Jackson | Attorney |

Learn More about Your Disability Approval Chances

The approval of an SSDI claim can bring much-needed economic support and stability. Although each claim is evaluated individually, certain signs indicate higher approval odds.

To increase your chances of approval, ensure you meet the eligibility criteria and provide medical evidence to support the claim. Contact our experts at Benefits.com for help navigating the medical evidence development process.

FAQ

Applying for disability benefits can be a confusing process. Below, we answer some common questions about the approval process.

Is Disability Usually Denied the First Time?

Yes, the SSA denies about 62% of applicants during the initial application process. This can result from inaccuracies on applications, missing documents, or the SSA’s belief that a filer’s condition isn’t as severe as their claim suggests.

Compiling written statements from doctors and medical evidence can drastically improve your odds of approval.

What Is the Hardest State To Get Disability Benefits?

As of 2024, Utah is the hardest state to initially get approved for SSDI. It has an approval rating of 44.64% for first-time applicants.

Who Is Eligible for Maximum Disability?

A person who meets the SSA’s work history and disability requirements is eligible for the maximum disability amount of $3,822 a month. If you have a disability that affects your ability to secure SGA and you’ve worked at least five of the last 10 years, you may qualify for the maximum SSDI benefits.

Conditions that are projected to last more than one year, render a person blind, or are terminal typically meet the SGA’s requirements. If a person is disabled and still aims to work, their earnings can’t exceed $1,550 per month or $2,590 if they’re blind.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.