The Temporary Assistance for Needy Families (TANF) program is a federal-level, block grant assistance program that helps provide financial support to states and U.S. territories to then be used for financially needy families with children. The program provides up to $16.5 billion in financial assistance each year.

In addition, federally recognized American Indian tribes and Alaska Native organizations may be eligible for TANF assistance through the tribal TANF program.

4 Broad Purposes of TANF

- Assist Needy Families

- End Dependence on Government Benefits

- Prevent Out-of-Wedlock Pregnancies

- Encourage Two-Parent Families

There are four chief purposes of the TANF program, as outlined in the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 that created the program. Ultimately designed to help very low-income families with children become self-sufficient, the TANF program provides financial support to eligible families with at least one minor child.

While the program exists to provide immediate, short-term assistance with acute needs, it ultimately seeks to help families find a way to become self-sufficient on their own.

What Is TANF?

TANF is a welfare program funded by the Office of Family Assistance, a division of the U.S. Department of Health and Human Services. The program provides monthly financial aid to eligible families. Each U.S. state, territory, and tribe has its own separate TANF program that is administered at the state, territory, or tribe level.

TANF was created in 1996 to replace the Aid to Families with Dependent Children program, which provided cash assistance directly to families with children who were experiencing poverty.

TANF exists to provide temporary financial support so that very low income families with at least one dependent child can become self-sufficient as quickly as possible. Grants are issued from the federal government to state-level entities, who then use them for financial assistance to families who qualify. States, territories, and tribes also may choose to use block grant funds to administer programs that encourage and provide appropriate training toward self-sufficiency for families.

IS TANF a State Program or Federal Program?

TANF is a national program that is administered at the federal level, but it also provides aid to American states and territories. However, instead of providing funds directly to low-income families, TANF provides a framework by which states and territories can use TANF grants to fund monthly cash assistance payments to low-income families with at least one dependent child.

States have the flexibility to use their TANF grants to fund a wide collection of support services to address one or more of the program’s four broad purposes. Sample state-administered programs may include child care assistance, job training, and assistance with finding employment.

4 Broad Purposes of TANF

If you think you may benefit from this program, keep reading – we’ve outlined everything you need to know about TANF and how it might be able to help you.

1. Assist Needy Families

One of the primary purposes of the TANF program is to ensure that very low-income families with children have access to resources that can help them in the short term. With TANF support, families who may be struggling can get the financial assistance they need to cover basic expenses and stay in their homes.

Much like the Supplemental Nutrition Assistance Program (SNAP), the Child and Adult Care Food Program (CACFP), and other similar assistance programs, TANF helps ensure that children have the basic necessities they need to grow and develop healthfully. If you are not eligible for Supplemental Security Income (SSI) benefits, you may be eligible for TANF benefits. Please note that you cannot get SSI and TANF benefits at the same time.

2. End Dependence on Government Benefits

One of TANF’s key purposes is to equip families to be self-sufficient over the long term. This effort translates into support services like job training or assistance finding employment. Most states have time limits on their TANF benefits, the most common of which is five years.

3. Prevent Out-of-Wedlock Pregnancies

Another of TANF’s key goals is helping recipients prevent accidental or unwanted pregnancies.

TANF is charged with establishing annual measurable goals for preventing and reducing the incidence of such pregnancies.

However, because the program provides so much flexibility at the state level, state activities to reduce nonmarital pregnancy are extremely varied. It’s also important to note that states spend relatively little of their available TANF grant dollars on activities or services that help prevent out-of-wedlock pregnancies.

4. Encourage Two-Parent Families

One of TANF’s chief purposes is to promote the stability typically associated with two-parent families, whether married or unmarried, living in the same household. However, it’s interesting to note that eligible two-parent families participate in TANF at lower rates than single-parent families. As recently as 2013, a mere 12% of families with two TANF-eligible parents received temporary cash assistance – compared with 28% of families with one eligible parent.

As it turns out, many TANF programs tend to offer the same services to single-parent or two-parent families. However, in some states, child care assistance is even less likely to be available to two-parent families and employment services may be offered only to one parent.

Ironically, frontline TANF representatives may assume that two-parent families have a lower need for child care assistance or other services than single parents – and may not offer assistance unless it is specifically requested.

TANF Eligibility Requirements

To qualify for TANF, applicants generally need to show the following:

- The applicant must be a resident of the state in which they are applying

- The applicant must be a U.S. citizen or legally authorized to live and work in the United States

- The applicant must be unemployed or underemployed, along with showing low or very low income

- The applicant must have a child 18 years old or younger, be pregnant or be 18 years old or younger, and be the head of a household.

Keep in mind that TANF programs are administered individually by each state, territory, or tribe. This means that eligibility criteria can change depending on the region, so make sure to check on the specific eligibility criteria that apply to your state, territory, or tribe.

Much like the Emergency Food Assistance Program (TEFAP) or other similar programs, TANF represents a federal-state partnership, with the state having tremendous flexibility in how grant funds are administered.

In addition to the general criteria listed above, successful TANF applicants must show a documented household income that is less than 50% of the median household income for their area. The applicable income limit primarily is determined by the average cost of living in each local area, plus the number of household members supported by the applicant’s documented income.

All adult TANF recipients are required either to be employed or to participate in approved work activities, which may include:

- Vocational education training

- On-the-job training

- Unsubsidized employment

- Job-search and job-readiness assistance

- Subsidized private-sector employment

- Job skills training

- Subsidized public-sector employment,

- Community service programs

- Child care services for those who are participating in a community service program

- Education related to employment or attendance at a high school, if the recipient is a minor

Each separate program will determine the level of work requirement that recipients must meet to remain eligible.

TANF recipients must also, in some cases, adhere to behavioral requirements, which generally include mandatory school attendance for minors, along with receiving all required medical vaccinations. For programs that include these types of requirements, any cash benefit may be limited until requirements are met.

In addition, some programs place limits on accrued assets – namely vehicles, stocks, and bonds. These programs will evaluate all applicants’ assets and will be considered eligible for a TANF benefit only if their accrued assets fall beneath the acceptable threshold.

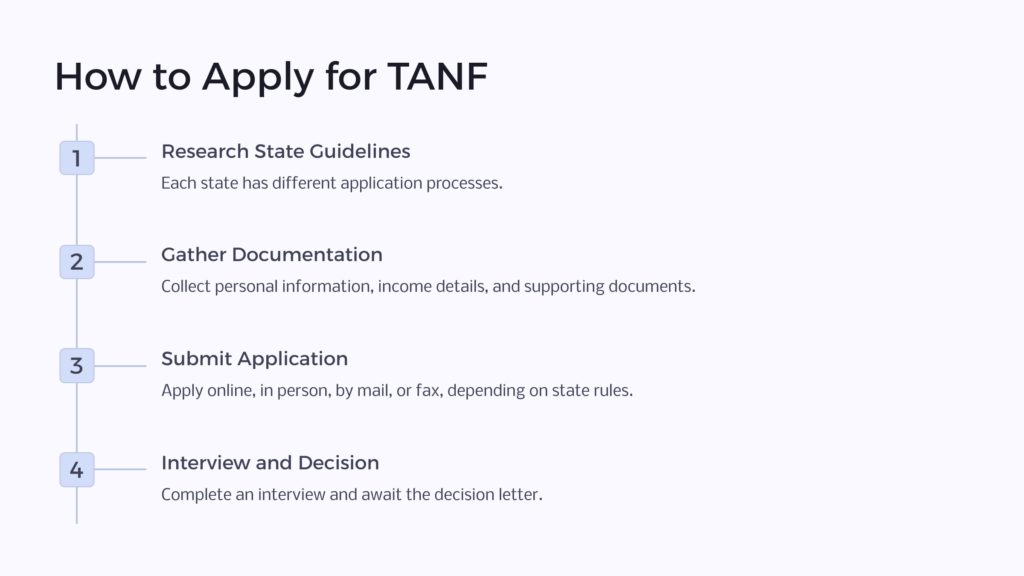

How To Apply for TANF

Each state may have different guidelines for how to apply, so you should make sure to research the particular TANF program for your state before applying. Depending on your specific program, you may be able to apply online, in person at your local Social Security office, by mail, or even by fax.

Once you know your method of application, you can gather all your supporting documentation. this should include not only your personal information but also that for everyone in your household.

This type of information includes full names, dates of birth, Social Security numbers, citizenship status, and marital status. In addition, you’ll need to disclose any criminal convictions, disabilities, veteran status, or other personal information as requested by your TANF caseworker.

Your income information is also important and pertinent information to provide. You will be expected to outline your income-related information, including name and contact information for your current employer, annual income, any income received from other assistance programs, and any additional income received from other sources, including self-employment.

You must also list current assets and current financial obligations, including recurring expenses like rent or mortgage, child care costs, utilities, and medical bills.

Below is a list of commonly included documents that you may be required to submit in support of your application:

- Driver’s license

- Birth certificate

- U.S. or foreign passport

- Immigration documents, including permanent resident card and/or certificate of naturalization

- Voter registration card

- Marriage license

- Adoption papers

- Public health records

- Utility bills

- Bank statements

- Rent receipts

- Tax receipts

- Pay stubs

- Employment statements

- Tax returns

- Retirement, disability, or other benefit award letters

- Mortgage documents

- Lease documents

- Vehicle purchase documents

- Statements from medical professionals verifying disability status

- Copies of medical examination reports

Once your application and supporting documentation are received, you likely will be asked to complete an interview with a TANF program representative. This interview represents your opportunity to connect personally with a program representative and offer any additional information that may help your claim.

Following your interview, you will receive a formal decision letter from your TANF program office. Once approved, you will begin receiving a monthly cash benefit to use for food, clothing, and other applicable expenses.

If your application for TANF benefits is denied, you do have the option to request an appeal from your local TANF program. The formal letter you receive from TANF will outline not only the reasons for your denial but also the steps you need to take to request an appeal.

What Can I Buy With TANF?

TANF policies vary by state, so it’s a good idea to talk to your local TANF office. Generally, TANF funds can be spend on anything that encourages the four broad purposes of TANF: Food, shelter, clothing, day care, and much more. Items like alcohol and tobacco products and not allowed.

TANF Fraud

The following behaviors are considered TANF fraud:

- An applicant providing false information on a TANF application to receive benefits or to increase the benefit amount

- An individual using TANF cash assistance to purchase restricted items or purchase items from restricted businesses

- A retailer who has been disqualified from the TANF program lying on an application to resume status as an approved EBT retailer

- A retailer accepting TANF funds as payment for unauthorized items

TANF takes fraud very seriously, and each TANF office has a specific process in place to discover it, including engaging in undercover investigations.

If you suspect someone of committing TANF fraud, you should report it immediately. You may do so by calling the national hotline at 800-HHS-TIPS or by contacting your state’s TANF agency. Depending on your area, you may be able to report fraud online, by mail, or over the phone.

Temporary Assistance for Needy Families

The Temporary Assistance for Needy Families represents an important federal-state partnership to help ensure that very low-income families with at least one child have a safety net.

According to the Institute for Family Studies, states spend roughly one-fourth of their available program funds providing income assistance to families, while approximately 16% of available TANF funds go toward child care assistance. Roughly another 7% is dedicated to work-related activities.

Since states vary widely in how they administer their programs, there is not much data on how the remaining funds are spent from state to state. If you feel that TANF assistance may be right for you and your family, it’s important to find out the specific requirements and benefits for your area so you can get the help your family needs.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.