Every year, the U.S. Department of Veterans Affairs (VA) receives a high number of disability claims from veterans with sleep apnea — in 2023 alone, over 500,000 U.S. veterans received disability benefits for sleep apnea. The inability to get the kind of restful sleep necessary for optimal health can affect a veteran’s ability to effectively secure and maintain gainful employment, which is often the case with sleep apnea, a common sleep disorder.

If you’re wondering if you qualify for VA disability benefits for sleep apnea, we’ve summarized all you need to know about the most common symptoms, sleep apnea VA ratings, and how you can qualify for benefits.

Table of contents:

What Is Sleep Apnea?

Sleep apnea is a chronic respiratory disorder that can be detrimental to a person’s health and well-being. People with untreated sleep apnea stop breathing throughout the night, resulting in decreased oxygen flow to the brain.

Because those affected aren’t getting as much oxygen, their bodies respond by waking them up briefly to breathe, creating a never-ending cycle of interrupted sleep. For veterans, sleep apnea may be caused by an existing service-related medical condition.

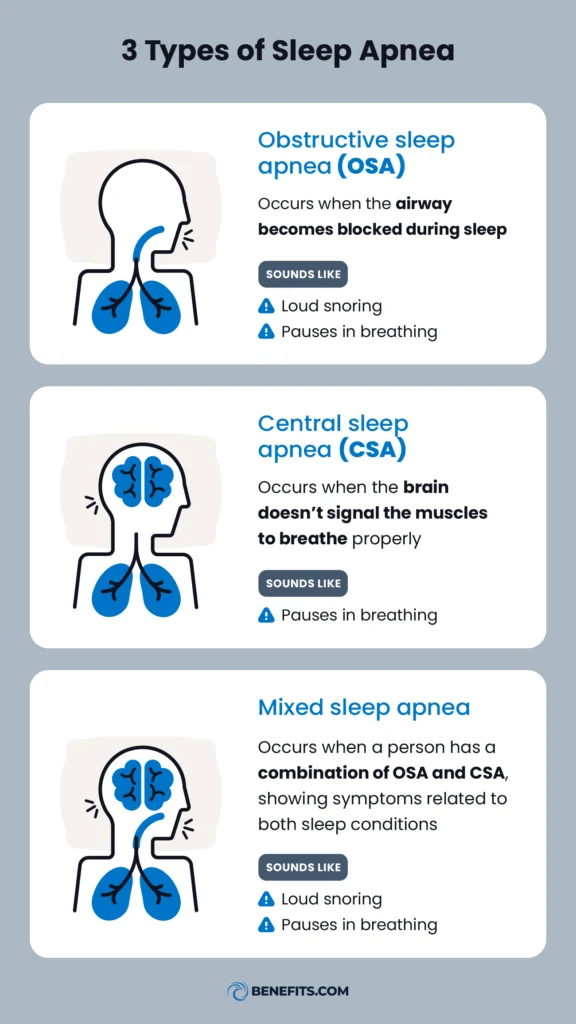

There are three types of sleep apnea, including:

- Obstructive sleep apnea (OSA): This is the most common form of sleep apnea and occurs when the airway becomes blocked during sleep — usually because the soft tissue collapses at the back of the throat. OSA affects around 39 million U.S. adults, and as many as 80% of people with OSA are undiagnosed.

- Central sleep apnea (CSA): With this kind of sleep apnea, the airway isn’t necessarily blocked during sleep, but the brain doesn’t signal the muscles to breathe appropriately. This usually ties back to some instability in the brain’s respiratory control center. Though not as common as OSA, heart conditions, age, and drug use can all increase a person’s risk of CSA.

- Mixed sleep apnea: Mixed sleep apnea, also known as complex sleep apnea, is when a person experiences both OSA and CSA.

Common Symptoms of Sleep Apnea

While every sleeper is different, sleep apnea presents several distinct symptoms. Some of the most common symptoms include:

- Loud snoring: Snoring associated with sleep apnea is characterized by long pauses in breathing followed by gasping, choking, snorting, or overall difficulty breathing.

- Dry mouth: Though dry mouth, also known as xerostomia, can be linked to other health conditions like gum disease and cavities, those with sleep apnea experience mouth breathing while sleeping, leading them to wake up with an extremely dry mouth.

- Excessive daytime sleepiness: The interruptions during sleep can cause excessive fatigue and an inability to concentrate, posing a risk to jobs requiring extreme focus.

- Headaches: Decreased oxygen levels throughout the night and carbon dioxide buildup can cause sleep apnea sufferers to wake up with headaches. Sleep apnea headaches usually cause pain on both sides of the head but dissipate once you wake up and begin breathing normally.

- Gasping for air: Obstructive sleep apnea leads sleepers to wake during the night gasping for air, sometimes feeling as if they’re suffocating. This common symptom happens because the throat muscles relax so much that they block your airway, causing you to wake abruptly and gasp to get air into your lungs.

What Causes Sleep Apnea in Veterans?

Sleep apnea causes vary, and sleep disorder research continues to uncover new connections. However, some of the most common causes of sleep apnea in veterans include:

- Age

- Trauma to the face

- Exposure to toxic chemicals, dust, and fumes

- Existing medical conditions

- PTSD and other mental health disorders

- Traumatic brain injuries (TBIs) and other service-related injuries

Other Conditions Related to Sleep Apnea

Several medical conditions can lead to the development of sleep apnea or worsen symptoms in veterans, including:

- Asthma: Research has shown that those with asthma have a nearly 40% greater risk of developing sleep apnea. Those with sleep apnea may already have weakened or irritated airways, which can make them inflamed and narrow, exacerbating both sleep apnea and asthma.

- Sinusitis: Sinusitis is when the sinuses become inflamed and cause pain around the face and eyes, nasal congestion, runny nose, headache, coughing, throat irritation, and difficulty sleeping. This can lead to sleep apnea or worsen symptoms for those who already have sleep apnea.

- Allergic rhinitis: Allergic rhinitis is when the inner lining of the nose becomes inflamed due to an allergic reaction. If you suffer from allergic rhinitis either seasonally or chronically, it can force you to breathe out of your mouth, worsening sleep apnea or increasing your chances of developing the condition.

- Deviated septum: People with a deviated septum will often breathe out of their mouth, especially at night, because their oxygen level is too low. Excessive mouth breathing can lead to dry mouth, sinus pressure, and mild sleep apnea.

- Diabetes: Those with type 2 diabetes are at a significantly higher risk of suffering from obstructive sleep apnea. Those with sleep apnea often experience stress related to sleep deprivation, which can trigger your body to release stored glucose, elevating blood sugar levels and worsening the effects of diabetes.

- ALS: Research has shown that people with amyotrophic lateral sclerosis (ALS) are more likely to suffer from sleep apnea since they experience nocturnal hypoventilation (periodic breathing), a key indicator of sleep apnea.

- Tinnitus: Tinnitus is a ringing, buzzing, or humming sound in the ears. This can disrupt sleep patterns, making it harder to get a good night’s rest, potentially exacerbating or leading to sleep apnea.

Is Sleep Apnea a Disability?

Sleep apnea may be considered a disability if it prevents you from working or is accompanied by another illness or medical condition.

Veterans may be eligible for benefits if they can prove their condition is related to their service by gathering evidence — like service records, medical exams, or statements from fellow service members — to help build a solid case. If a veteran can show that these conditions were caused or worsened by their time in service, they might be eligible for compensation.

Sleep Apnea VA Rating

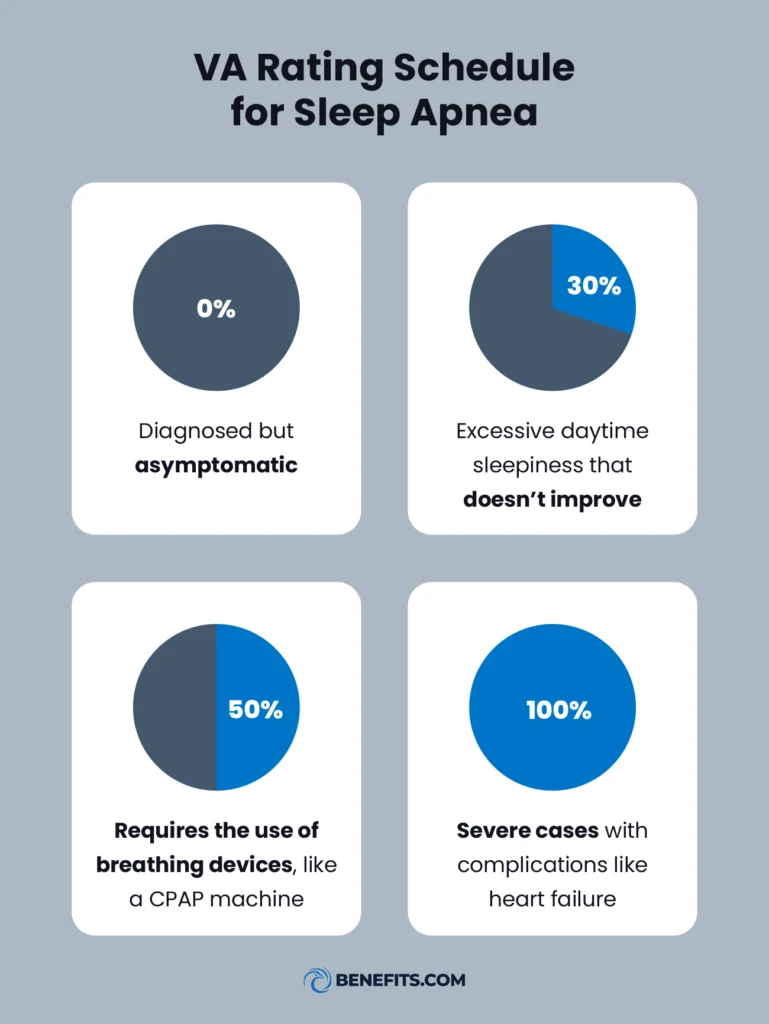

As with most disabilities, the VA disability rating for sleep apnea depends on your situation. The sleep apnea VA ratings are as follows:

- 0%: Indicates that the claimant is largely asymptomatic but does show documented sleep apnea

- 30%: Signified by excessive daytime hypersomnolence — chronic daytime sleepiness — that doesn’t improve even when you get the recommended amount of sleep and impacts daily activities

- 50%: Requires assistance to breathe healthily during the night, including sleeping with a continuous airway pressure device, CPAP machine, dental appliances, or other devices designed to keep your airway open and prevent periods of suspended breathing throughout the night

- 100%: Chronic respiratory failure that includes carbon dioxide retention or “cor pulmonale” — enlargement or failure of the right side of the heart; this level of respiratory disability may also require a tracheostomy

It’s important to note that the VA has proposed recent changes to the VA ratings for sleep apnea, which could go into effect soon. The new proposed rating scale would be 0%, 10%, 50%, and 100%, with the qualification criteria determined by your response to treatment. For example, if your symptoms are well-controlled with a CPAP machine or other treatments, you’d receive a veteran rating of 0% with no compensation.

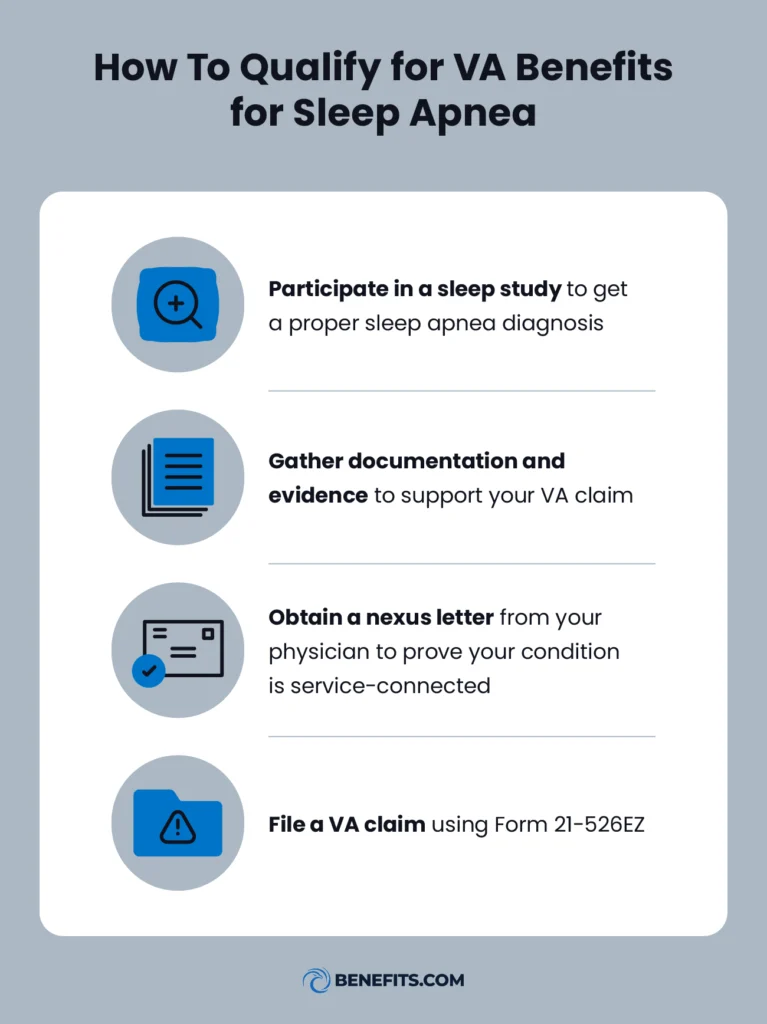

How To Qualify for VA Benefits for Sleep Apnea

Qualifying for VA benefits for sleep apnea is simple so long as you have a proper diagnosis and sufficient documentation. Follow the steps outlined below to file your claim.

1. Get a Diagnosis

Before considering your VA claim for a sleep apnea VA rating, the VA will insist that you provide the results of a sleep study, which can help define the severity of your medical condition.

You can undergo a polysomnogram that measures brain activity, blood pressure, eye movements, blood oxygen levels, heart rate, snoring, and chest movements throughout the night as you sleep. This sleep study typically occurs at a medical facility or specialized sleep lab.

You can also sleep with a home-based monitor that records much of the same information while allowing you to sleep in your bed at home. Depending on the home test results, a sleep specialist may advise that you follow up with a more formal sleep study as part of your VA claim.

2. Gather Evidence

Next, you’ll want to gather evidence to show that your sleep apnea developed or worsened during your service. Evidence to support your claim may include:

- Medical records during your service that mention sleep problems

- Test results and sleep reports proving your condition

- Medical records of primary illnesses or other conditions that may have led to the development of sleep apnea

- Statements from your doctor that explain how your service may have caused or worsened your condition

- Statements from fellow veterans who served alongside you and witnessed your sleep problems

3. Obtain a Nexus Letter

To prove your condition is connected to your service, you’ll need to obtain a nexus letter. A nexus letter is a document written by a physician on your behalf that shows how your medical illness or condition relates to your service. Look for a doctor specializing in sleep medicine, preferably one with experience handling VA claims. A specialist with a solid reputation can provide an authoritative opinion that carries significant weight during the claims process.

Your doctor will need to write about your sleep apnea symptoms, how they impact your daily life, and when they first appeared. They’ll also need to explain how your military duties, such as exposure to loud noises, hazardous substances, or extreme stress, could have contributed to your sleep apnea developing or worsening.

Your nexus letter should also refer to the relevant medical records, test results, and sleep study reports you gathered. Be sure to include dates, locations, and any other relevant information that strengthens the link between your condition and service.

4. File a Claim

For sleep apnea claims, you’ll need to file Form 21-526EZ along with your nexus letter and any other supporting service records and medical documentation. If your claim gets denied initially, don’t give up. Appeal the decision and continue pushing forward. Once your VA claim has been approved, you also may be eligible for VA disability back pay.

Frequently Asked Questions

Here are answers to a few common questions regarding sleep apnea VA ratings and the qualification process.

Is Sleep Apnea Hard To Claim With the VA?

If you can prove your sleep apnea is service-related, you should have no problem getting your claim approved. When your sleep disturbance symptoms are supported with the right kind of documentation, there’s no reason to believe that the VA would deny your sleep apnea claim. If they deny your claim, you can try to win your case through the appeals process.

Is It a Mandatory 50% Rating if Issued a CPAP by the VA?

The VA assigns a 50% disability rating and offers financial compensation to veterans who require a CPAP machine. However, if the new proposed ratings go into effect by the time of your claim, you would only get a 50% rating if your CPAP machine or other treatment is ineffective.

How Do You Prove Your Sleep Apnea Is Service-Connected?

The key to proving your sleep apnea is service-connected is through the proper documentation and supporting evidence.

This can include proof that you were diagnosed during your time of service, medical records that show sleep apnea developed due to a service-related condition, statements from your health care provider, and statements from other veterans who witnessed your condition during your service.

Benefits.com Can Help You File for VA Disability Benefits

Winning a VA disability claim for sleep apnea and similar respiratory conditions is an uphill battle, but it isn’t impossible. With the above information, Benefits.com can help you evaluate the strength of your sleep apnea disability claim and decide whether applying for compensation is the best path based on your estimated sleep apnea VA rating.

To learn more, take our Benefits Quiz to find out how much you may qualify for.

Benefits.com Advisors

Benefits.com Advisors

With expertise spanning local, state, and federal benefit programs, our team is dedicated to guiding individuals towards the perfect program tailored to their unique circumstances.

Rise to the top with Peak Benefits!

Join our Peak Benefits Newsletter for the latest news, resources, and offers on all things government benefits.